British Insurance Brokers’ Association (Biba)

Preview: What will 2022 bring for the insurance market?

Post spoke to market experts to get their predictions for what 2022 will look like.

Review of the Year 2021 – Brokers and MGAs

Post spoke to brokers and MGAs to get their thoughts on the highs and lows of 2021.

Vox Pop: Regulation 20 years on from the FSA coming to power – part two

The Financial Services Authority came into force on 1 December 2001. In this anniversary month, in the second of a two-part vox-pop series, Post asks compliance experts for their thoughts on topics including the accountability of the Financial Conduct…

Vox Pop: Regulation 20 years on from the FSA coming to power – part one

The Financial Services Authority came into force on 1 December 2001. In this anniversary month, in the first of a two-part vox-pop series, Post asks compliance experts for their thoughts on how seismic a change the launch was and the current scope of…

Interview: Johnny Timpson

Post meets Johnny Timpson, the driving force behind the Access to Insurance Working Group, which led to the creation of the British Insurance Brokers’ Association’s Access to Insurance Committee launched last summer.

Marsh appoints head of climate and sustainability insurance innovation

Marsh has appointed Ryan Bond as head of climate and sustainability insurance innovation effective 1 January 2022.

HMRC's IPT decision hailed as good news for brokers

Her Majesty’s Revenue & Customs has opted against making brokers liable for any unpaid Insurance Premium Tax where they used IPT unregistered insurers and against introducing IPT on brokers’ administration fees.

Former A2I leader Timpson named Grief Chat ambassador

Johnny Timpson, ex Cabinet Office disability and access champion for insurance, has become financial services sector ambassador for Grief Chat.

Analysis: Covid-19's lasting impact on cover for other diseases

Brokers are concerned that the availability of cover for historically insurable diseases may not return to pre-pandemic levels, having been much reduced as a result of exclusions written into policies.

FSCS cancels 2021/22 retail pool contribution but forecasts £900m levy for following year

The Financial Services Compensation Scheme has dropped its 2021/22 levy to £717m from a forecast £833m as it cancelled the predicted £116m contribution to the retail pool.

IPT untouched in Autumn Budget

Insurance premium tax went unmentioned in the Autumn Budget announcement.

Lockdown customer champion: Dipesh Patel, JLU

As vaccinated travellers struggled to bag Covid cover amid easing restrictions, Jackson Lee Underwriting came up with the goods. Senior underwriter Dipesh Patel tells Post how the business brought its wholesale solution to market with capacity provider…

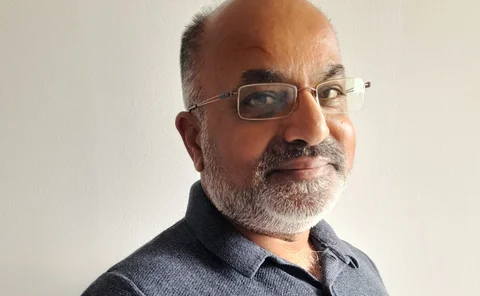

Lockdown customer champion: Johnny Timpson

Johnny Timpson tells Post why the pandemic put the importance of the Access to Insurance mission on steroids and the challenges it faced coming to fruition as the Covid crisis hit.

Biba calls on FCA to cut out 'jargon' amid product governance confusion

The British Insurance Brokers’ Association has called for the Financial Conduct Authority to cut down on the amount of jargon in its rulebook, saying that the terminology used in new product governance rules risks confusing brokers.

Motor insurance sees biggest drop for seven years; Apollo gets new investment; Axa sets aside €1.5bn to fight deforestation; Nexus refinances; and Radius acquires Milestone

Post wraps up the major insurance deals, launches and investments of the week

Trade bodies collaborate on product governance amid concerns of sluggish progress

Insurance industry trade bodies are working to agree templates for information sharing between firms to enable them to more easily come into line with the Financial Conduct Authority’s enhanced product governance rules.

Analysis: Commission in the crosshairs as FCA warns on product governance rules

The shift in the regulatory landscape could lead to “massive upheaval” experts have warned as brokers have been urged to engage with the process amid fears that the scope of fair value changes has not been understood.

Spotlight on open banking and SME: Open banking will play an important part in meeting customers’ needs

Despite slow progress to date there are signs that some in the insurance sector are starting to get a handle on the value of open banking. On the back of a survey, in conjunction with Crif Decision Solutions, Post highlights some of the benefits that…

Intelligence: Insurance and politics - a story of slow progress

From when the All Party Parliamentary Group on Insurance & Financial Services was established in 1991 to the infamous 10 Downing Street summit on Valentine’s Day 2012 insurance and politics often cross paths. Post investigates the impact insurance has…

Intelligence: No time to hide on Scottish independence

A second independence referendum raised its head again in the recent elections for the Scottish Parliament, Post investigates what this would mean for the UK insurance sector

Covid-19 pandemic drives Biba turnover down 36%

The British Insurance Brokers’ Association’s turnover fell by 36% in 2020, however, funds ticked up slightly to just over £4m in the period.

FCA delays to approving c-suite broker roles slammed as outrageous

Compliance experts have advised brokers to add time into their recruitment plans for c-suite positions to account for “backlogs” in the Financial Conduct Authority’s approval process as one leading broker hit out at the “ridiculous” delays.

Climate Wise outlines priorities; WTW claims Lloyd's digital first with Ki; AIG publishes ESG report; Freedom secures funding

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Interview: Bruce Goodbrand and Kevin Shevlin, Forum of Insurance Lawyers

Forum of Insurance Lawyers Scotland chair Bruce Goodbrand and Northern Ireland chair Kevin Shevlin spoke to Post about how different arms of Foil work together to address the issues the industry is facing and also learn from one another.