Training

Biba’s Chapman on the enduring power of events

Trade Voice: Emma Chapman, the British Insurance Brokers’ Association’s conference director, considers the persistent importance of face-to-face events to the industry in the Zoom age.

Q&A: Jonathan Hewett, Thatcham Research

Jonathan Hewett, CEO, Thatcham Research offers an insight into its shifting relationship with manufacturers; grappling with EV reparability; and emerging motor risks.

Big Interview: Matthew Hill, Chartered Insurance Institute

Matthew Hill, the third CEO of the Chartered Insurance Institute in as many years, knows only 10 Downing Street has had a faster revolving door than the industry’s professional body in recent years.

Diary of an Insurer: QBE’s David Round

David Round, head of trading at Birmingham at QBE Europe, gets more active, explores future opportunities and threats to the renewal portfolio and even manages to keep score at his son’s cricket match.

Are insurers racing to be online-only excluding disabled customers?

As the insurance sector increasingly digitises, Damisola Sulaiman examines the barriers disabled customers face in accessing online insurance services, as well as the measures that have been implemented by insurers to address these issues.

Operational resilience: will insurers meet the March 2025 deadline?

Sarah Ouarbya, partner for financial services consulting at Forvis Mazars, examines how insurers should prepare for the Financial Conduct Authority and the Prudential Regulation Authority’s operational resilience rules coming into force.

Diary of an Insurance PR: NextGen’s Roma Braithwaite

Roma Braithwaite, NextGen Communications’ PR and media consultant, is a mother of 10-year-old twins, local sea-swimmer, mega-plan organiser and is getting ready for Monte Carlo’s Rendez-Vous.

Gallagher’s King on securing talent pools

View from the Top: Wendy King, managing director of talent acquisition at Gallagher, outlines what insurers and brokers need to do to secure their talent pools.

How to create an inclusive insurance company

How to make sure the insurance industry attracts and retains a wider pool of talent is the topic of the latest Insurance Post Top Tips video, featuring Caroline Taylor, chief operating officer of Acies MGU.

DynaRisk’s Martin on the insurance industry’s cyber resilience

DynaRisk’s Andrew Martin discusses the cyber resilience of UK insurance firms, exploring hacker motivations, common threats and challenges that firms face.

Crunch time for insurers’ Consumer Duty reports

One year on from the introduction of the Financial Conduct Authority’s Consumer Duty requirements for open products, Emma Ann Hughes investigates whether insurers will get a pat on the back or a clip round the ear from the regulator when they hand in…

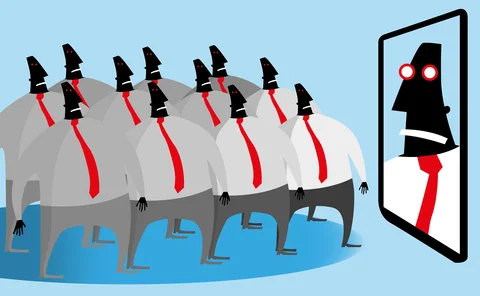

Big Brother is watching 45% of insurance employees

Almost half (45%) of insurance employees have their working time strictly monitored with 41% admitting leaders are always watching whether they’re on task during work hours.

Best Insurance Employers to work for in 2024 revealed

First Central and Konsileo are the greatest large and small to medium-sized insurance employers in the UK respectively to work for, according to Insurance Post’s Best Insurance Employers survey.

British Insurance Awards 2024 winners revealed

Aviva was among the big winners with four outright prizes at last night’s (3 July) British Insurance Awards, on an evening where former British Insurance Brokers’ Association CEO Steve White was recognised with The Achievement Award.

Loss adjusters pay tribute to Mike Odell

The insurance industry has paid its respects to “true gentleman” and “advocate for the loss adjusting profession” Mike Odell, who passed away on Saturday (29 June).

Sedgwick’s Crystal says insurers should embrace neurodiversity

Nathalie Crystal, senior public relations manager for Sedgwick in the UK, has urged the industry to ditch traditional hiring methods, in order to bring in more neurodivergent talent.

How to become an underwriting trailblazer

Only 8% of insurers can consider themselves to be property and casualty underwriting trailblazers, according to a survey of the sector.

Cila’s latest hire aims to boost membership

The Chartered Institute of Loss Adjusters has hired former Dulwich College donor engagement manager Sarah McAvoy-Edwards to boost membership numbers and increase uptake of qualifications.

Axa reveals AI pilots being rolled out across business

Axa has more than half of its artificial intelligence use cases already in production, according to Axa XL chief innovation, data analytics officer Ashok Krishnan.

Blueprint Two rollout hit by more delays

The first phase of the rollout of Blueprint Two has been pushed back again, due to testing of the technology running behind schedule.

Hiscox uses AI to slash underwriting from three days to three minutes

Hiscox has shortened its lead underwriting journey for the London Market sabotage and terrorism book from three days to three minutes through the use of generative artificial intelligence.

How generative AI is everything, everywhere in insurance all at once

How insurers have been able to swiftly pilot generative artificial intelligence, prove the value of embracing this technology and roll it out across the wider business is examined by Insurance Post Editor Emma Ann Hughes.

QBE’s Gudhka shares seven steps to manage GenAI risks

Jaini Gudhka, senior risk manager at QBE, shares the seven steps businesses can take to manage generative artificial intelligence risks.

How insurers can up their claims game

Insurers love to talk about claims exaggeration, but David Worsfold asks: are they guilty of some exaggeration of their own?