A museum of insurance: opening up the past to attract the future

Need to know

- Former CII president Reg Brown believes an insurance museum could blow young minds and attract them into the sector in a similar way to the Bank of England’s museum

- He will be able to fully assess what the CII has in its vault when the institute moves out this month

- Among the options being considered is a permanent home within the new Museum of London

- Brown would prefer a museum close to Lime Street and funded by the market

When the Chartered Insurance Institute leaves Aldermanbury this month for a new home in the City, it will not be able to bring along many of the artifacts it has in storage. Post spoke to former president Reg Brown about how these could be rehoused in a dedicated insurance museum

London has a museum of brands, packaging and advertising (Notting Hill) and it has a dental museum (Marylebone). The capital even has museum dedicated to sewing machines (Balham). So why should the idea of a museum dedicated to insurance be so far-fetched? The Bank of England has one, after all.

Well such a memorial to the profession is very much now under consideration as part of the Chartered Insurance Institute’s move from Aldermanbury to the heart of the City. Especially now that it will no longer have so much storage space to hold its wide-ranging collection of material.

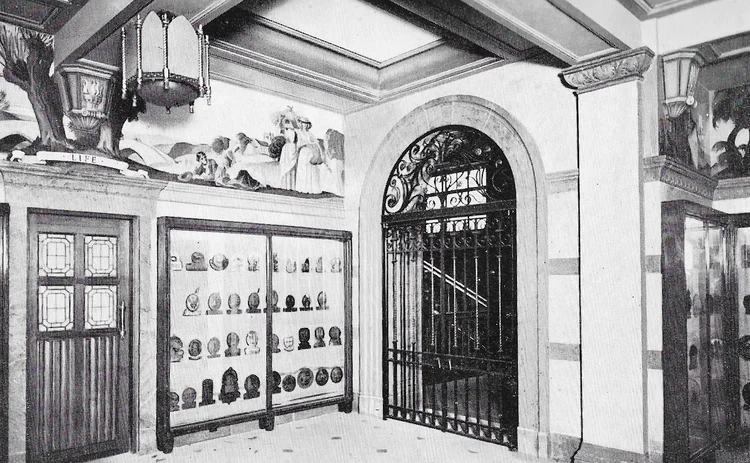

To be fair, the CII does have a room in its current premises dedicated to showing off some of its collection, but calling it a museum might be stretching it.

Items of value

Charged with looking at the options for these objects and the many others it owns is former CII president and British Insurance Awards achievement winner Reg Brown, who is quick to put down a marker as to what he considers items of value, and what he doesn’t.

“It should be said that there is a lot of difference between archive and what I consider museum pieces,” he said. “Because who wants to read the minutes of a CII board meeting from 30 years ago? So I’m really only interested in the museum stuff. Things people might want to see.

Reg Brown on the wanted

My hobby is that I’m a deltiologist and what keeps me amused – if I have nothing better to do – is to go to postcard fairs and I buy insurance-related postcards. I have over 8000 in my collection. But I also buy some on Ebay and very often I am outbid by other nutcases like me.

Reg Brown on the unwanted

In the Chartered Insurance Institute building, there is a painting on the second floor of a horse-drawn fire engine going to a blaze. It is quite a dark and dingy painting. I don’t think anyone going up the stairs would stop to look at it. But underneath there is a sign that says ‘On loan to the CII from the Essex and Suffolk Fire and Insurance Company’. Now this was taken over by a company, that was then taken over by Guardian Royal Exchange, that was in turn taken over by Axa. But can I get anyone from Axa to do anything about it? No. I took [Axa technical director] David Williams up there a few weeks ago and said: ‘That is your painting. What do you want me to do with it?’ It has apparently been valued at £35,000. But no one can give me an answer.

“But it is amazing how much stuff the CII has in its vault which never sees the light of day. It is amazing how much Lloyd’s has in its vault that never sees the light of day. And I’m going up to Norwich in September to see Aviva and it claims it has the best insurance archive in the world, although I don’t know how much of that could be museum pieces.”

According to Brown, most insurers have stuff that never come out of the London Metropolitan Archives. And yet the LMA, which is owned, funded and managed by the City of London Corporation, is free to use and open to everyone. It has 100km of the capital’s documentary heritage dating from 1067 to the present day, from parchment rolls to digital files.

“We are just across the road from the Bank of England Museum and that is my inspiration,” said Brown. “I have had a chat with the curator there and I’ve tried to persuade her to make it a Bank of England and insurance museum and she said: ‘No deal, mate. This is not even a bank museum, it is the Bank of England Museum’.

“But it has a lovely museum and a great lecture theatre. I’ve been there with school kids and it blows their minds. My interest is the next generation of insurance workers, and people keep moaning about a lack of talent. But the talent is there, you just have to find it and attract it, and blow their minds too. And we don’t do any of that.

“Lloyd’s closed its exhibition centre a long time ago and most of the insurers have bunged their stuff in the LMA. Which is where the CII stuff could end up. But it wants £130,000 for the privilege of looking after it and an annual contribution. It keeps berating me to have a chat but we are keeping our options open.”

Brown added: “Another opportunity - which is fascinating - is the Museum of London. Now that is going to move over the next few years to premises in Smithfield which the Corporation of London has allowed it to have.

“But it will have to raise quite a bit of money as the building is in a state of some disrepair. It is mostly underground and a multiple of the site that it has got now.”

Up in the air

However, the timing for the Museum of London move is still somewhat in the air, with even its own website admitting: “The [Smithfield] buildings are currently in a terrible state with huge amounts of damage and rot, a lot of work will have to go into the buildings just to make them safe and then there will have to be the modifications to transform a market site into a museum.”

As a result, it is no surprise that the museum’s opening date has moved from an initial plan of 2021 to 12 months later, with Brown unsure that might even be feasible.

“Now assuming it raises the money, what we understand from their chair Clive Bannister is that it wants to get away from the old Roman London notion, and move to something that better reflects a modern city. With that in mind, an insurance sector exhibition would fit the bill perfectly,” he continued.

“My worry is that if 20 Aldermanbury was a bit off the beaten track, then the Museum of London [near the Barbican] is further off the beaten track, and Smithfield is even further still.

“So the Museum of London is still a possibility, but one contingent on it raising around £40m. And I keep hearing different dates about when it might open up, including 2025. I would estimate it might be as long as 10 years before it is smart and capable of admitting members of the public.”

Would insurers back a museum of insurance?

Where do you keep your historical artifacts?

RSA: RSA has a number of historic items on display in our London (20 Fenchurch Street), Liverpool and Chelmsford offices and is always happy to answer any questions about them. We currently store a number of our archive artifacts in an offsite storage facility. However, we are currently revisiting our archive strategy. We have in the past also donated to Guildhall and Museum of London.

Aviva: Our artifacts are kept in the archive. They are used in the displays we put up in Marble Hall (in Norwich) in showcases and they are put out on show when we give tours of the archive.

Lloyd’s: We have most of our historical artifacts, primarily our Nelson collection, on permanent display on our history floor within the Lloyd’s Building in Lime Street, London. Old policy documentation would be the property of individual syndicates.

Would you be willing to lend artifacts if an Insurance Museum was ever established?

RSA: Yes, we would, dependent on where it was and how it was promoted. We would want to be sure that a standalone insurance museum would receive sufficient footfall and interest. It may be that these insurance artifacts could be part of a larger museum. We would also be happy to loan pieces from our archive to museums local to our offices/branches.

Aviva: We would be willing to loan to a museum and we have done in the past. All we would need would be for the museum to satisfy our standards in security and display conditions.

Lloyd’s: Should a museum be established, we would, of course, be open to discussing which artifacts Lloyd’s owns which would be of appeal to such a museum and would be open to supporting any requests. Reg Brown has already been in contact with our corporate real estate team.

Next step

Brown’s next step hinges on the CII moving out of the existing premises so he can assess what it has. With a date looking likely for mid-September, he is eager and ready to go.

“What my little committee have been waiting for is the CII to get out and then we can get everything together in the Great Hall and see it all,” he said.

“I still don’t know exactly what is in the safe. What I do know is in there is all the past president’s medals, which are all quite valuable. And every time an institute closes – and Folkestone was the last – it sends the stuff to Aldermanbury. It bungs it in the safe never to see the light of day. And I am waiting for a list and proper valuation, because some of it must be valuable.”

From the date of the move, Brown and his team have until the end of October, when the institute hands over the building to the Corporation of London, to fully evaluate the cache. But he is relaxed on making a final decision, as he notes that the CII has a storage facility in Woolwich with plenty of space that can help it buy time.

Which brings us to the final option of a dedicated insurance museum, funded by the market.

“It saddens me that here in the centre of the insurance market, we don’t have a museum,” Brown said. “I understand it would cost a fortune to buy a building.

“But why could we not set it up as a charity to run this museum and rent a building somewhere? There are so many buildings going up in the City it could be one of those. But it has to be close to Lime Street.”

Asked how much space he would need, he responded: “If I could inspire the entire insurance market and get them enthused by the idea, who knows? But I’m having a ball. I was told getting an insurance museum off the ground is an impossible task, but I love impossible challenges.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk