Personal

Ghost broker busting – how can they be blasted off social media?

Content Director's View: If there’s something weird selling motor cover and it don’t look good … why do so many young drivers fall for ghost brokers on social media and what can be done to bust them, asks Insurance Post's Jonathan Swift.

Home insurers that reject half of claims named and shamed

Consumer watchdog Which? has named and shamed home insurers with a claims acceptance rate of less than 55%.

Direct Line CIO Jokhoo to leave at the end of the year

Direct Line Group’s chief information officer, Ash Jokhoo, is to leave the insurer at the end of the year, Insurance Post can reveal.

LexisNexis develops check to address ‘squeeze on consumer finances’

LexisNexis has started to offer insurance providers predictive credit reporting and affordability solutions, in the aftermath of the industry’s premium finance issues.

Value concerns moving personal injury claims out of OIC portal

More claims are moving from the Official Injury Claim portal to the Ministry of Justice portal due to valuation concerns, according to Verisk Claims.

Sign up for webinar on driving retention, growth and improved customer journeys

Insurers continue to face the challenge of distinguishing and differentiating themselves on anything other than being among the cheapest providers.

Insurers shift to being net zero accelerators

How insurers are helping companies decarbonise sooner rather than later is examined in the first of two special Insurance Post Podcasts, to coincide with the 2024 United Nations Climate Change Conference, more commonly known as COP29.

2024 European Insurance Technology Awards winners revealed

Today, Insurance Post is delighted to announce the winners of 2024 European Insurance Technology Awards.

One in five pothole-damaged cars must be written off

Following a £500m pledge by the government to address the pothole issue in the UK, research from Allianz has revealed that one in five claims where a vehicle has hit a pothole leads to the vehicle being written off.

One in three young drivers scammed by ghost brokers

An Aviva survey of 2000 drivers aged 17-25 found nearly one in three young motorists have purchased car insurance from a ghost broker on social media.

Pace of general insurers’ race to net zero revealed

As the 2024 United Nations Climate Change Conference, known as Cop 29, begins in Baku, Azerbaijan, Insurance Post’s Emma Ann Hughes analyses the pace of providers racing to become net zero heroes.

Esure transformation leads to layoffs for long-serving staff

Esure cut jobs of long-serving, frontline colleagues during its transformation programme due to digital efficiencies resulting in customer behaviour changes.

Crash for cash crooks collide with justice

Keoghs and Aviva have secured custodial sentences against four fraudsters who targeted an elderly motorist and staged an accident.

Insurers must embrace rather than resist motor OEM disruption

Delegates at the Insurance Innovators conference were told to welcome fresh competition from original equipment manufacturers, and that they don't have a "God-given right" to be the only ones to sell insurance.

FCA takes trio to court for arranging vacuum cover

The Financial Conduct Authority has started criminal proceedings against three individuals accused of arranging insurance cover for vacuum cleaners without the regulator’s permission.

ManyPets exits US market

ManyPets has exited the US market to focus on the UK, after exiting the Swedish market last year.

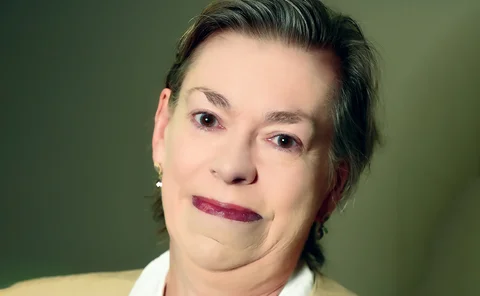

Mass’s Sue Brown on what to expect from Labour

Trade Voice: Sue Brown, chair of the Motor Accident Solicitors Society, looks at whether the Labour government might usher in a sea change on civil justice issues.

Portion of buildings underinsured falls to six-year low

The percentage of UK buildings that are underinsured has fallen to its lowest level for at least six years, but remains “unacceptably high”, according to data from valuations provider Rebuild Cost Assessment.

Tesco merges insurance and money services following Barclays sale

Tesco has sold its banking operations to Barclays, the firm confirmed this morning in a press release.

How the FCA could address premium finance failings

Marc Maxfield, risk and regulation expert at PA Consulting, explains what steps the regulator could take to reduce profiteering from premium finance plus how insurers should prepare for the watchdog's probe now.

Allianz and Aviva reportedly considering Esure bids

According to a report by Bloomberg, both Allianz and Aviva are considering bids for Esure, which has been owned by Bain Capital since 2018.