Webinars

About our webinars

Our webinars are built around expert journalism and provide news, opinion and insight on the latest industry developments.

Previous Webinars

Webinar: Watch Ageas, Abacai and WNS discuss how insurance providers can unlock the power of ‘smart data’

In a post-pandemic digital economy, success in the insurance sector largely depends on an ability to offer an omni-channel experience for its customers built around their actual needs and requirements.

Webinar: Watch Aviva, First Central, Markel and Salesforce discuss the CX lessons every insurer should know

In a fast-changing market, insurers cannot afford to stand still. Covid accelerated the move to digital channels. Now cost of living pressures are adding to consumer demand for ever more competitive deals, outstanding service and a seamless customer…

Webinar: Operational automation for insurers - how to increase efficiency and boost profitability

Insurance organisations today are under more scrutiny than ever from auditors and stakeholders alike. In response, many continue to shift their efforts from the digital transformation of front-end functions to driving higher levels of efficiency and…

Webinar: Looking to a sustainable ‘new normal’ – what does the future of motor claims look like?

With the lifting of Covid-19 restrictions, and as the UK races into recession with high inflation, the insurance sector is now starting to assess what the ‘new normal’ looks like in terms of motor claim numbers, value and supply chain adjustments to meet…

Webinar: Watch Lloyd’s, WTW and Apollo discuss the future growth of the London insurance market on the global stage

In an ever-changing world where globalisation brings new challenges and competition, Lloyd’s and London market insurance companies must remain vigilant and maintain high standards in the way they govern their companies and look to innovate.

Webinar: How do insurers – from the hottest insurtechs to the enterprise players – level up?

Climate change. Inflation. demanding consumers. regulation. M&A activity. Insurance looks nothing like it did a decade – or even five years ago.

Webinar: How can insurance companies adjust to the ‘new norm’ to optimise their hybrid workforce - and avoid their own great resignation?

Most insurance businesses have effectively been operating in a hybrid manner since Covid-19 restrictions required most employees to work from home.

Webinar: How can insurers harness new technologies to level up with customer expectations and future-proof the industry?

There has been a lot of discussion around digital acceleration over recent years, with the pandemic playing an undoubted role in escalating customer expectations as to how businesses engage and service them.

Webinar: Don’t forget the data – why digital transformation alone won’t help you improve your CX

“Digital transformation” has certainly been an on-trend phrase for many years now, with insurers investing fortunes in improving their customer experience across the policy lifecycle from the sale to claim/renewal.

Webinar: Transitioning to usage-based insurance - what are the benefits to being in the fast lane of UBI adoption?

Over the last two years insurance customers have had a chance to reflect on what they pay for their motor insurance; and whether they are getting fair value.

Webinar: Do believe the hype - how insurance hyperautomation will unleash your pricing, marketing and sales strategies

In recent years, traditional carriers have begun the transition from human-intensive tasks to a degree of automation using tools such as RPAs to reduce costs and increase the speed of delivery.

Digital claims – the final frontier

Within insurance, claims represent the ‘moment of truth’ for customers during their time of need. Digital claims could be the last big hurrah for insurers as they strive to improve combined ratios, gain a competitive edge and improve the customer journey.

Breaking down barriers and smashing silos to become truly customer centric

Is it too difficult to imagine a world where the policyholder is front-and-centre of everything that an insurance company does?

How AI and machine learning is changing the way Insurers process claims

In Insurance, everything comes down to claims. An insurer's ability to handle claims efficiently and accurately drives its profitability, customer experience, and long-term financial health.

The future of pricing - how can insurers use data and technology to remain competitive?

Insurance organisations need to develop new ways of pricing if they want to remain competitive in today’s market. But whilst data enables insurers to make the most informed pricing decisions; governing and processing this data across siloed databases and…

Modernizing data platforms - are insurers ready?

Insurance companies hold large volumes of customer data across the value chain, however the systems that contain it are usually slow and outdated. Which can be a major drawback as time when insurers need to expand their offerings with agile data…

The future of insurance fraud

While fraud practices have evolved over the years, in more recent times insurers have been able to better detect fraud and have seen significant savings.

Digital disruption in insurance – managing indemnity spend on escape of water claims

Insurers are grappling with rising escape of water claims costs. One of the most common types of domestic property damage claims, insurers are paying out an estimated 2.5 million every day, according to the Association of British Insurers.

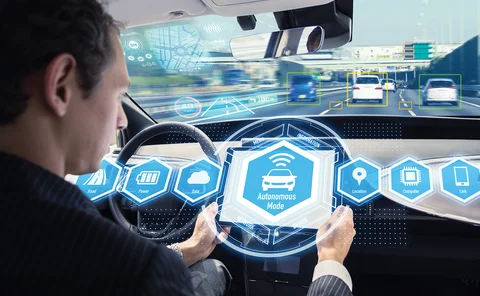

The ADAS tipping point – are motor insurers ready as the technology finally goes mainstream?

Advanced driver assistance systems have been part of new vehicles for over a decade now, with these features becoming increasingly common as manufacturers look to gain competitive advantages over rivals.

Axa XL, Allianz and Covéa discussed how technical debt is holding the insurance industry back

Post hosted a live webinar in association with Duck Creek Technologies, where an expert panel discussed how evergreen technology can deliver better customer experiences and help insurers to differentiate themselves in the market.

Aon and Gallagher discussed how artificial intelligence enables effective claims processing

Post in association with Nuxeo hosted a live webinar where an expert panel discussed how AI can improve both accuracy and efficiency during the claims process and has a positive impact on customer experience.

Gallagher, RSA and Amwins Group Risks discussed how insurance companies are developing career paths for future talent

Post in association with Davies Group hosted a live webinar where an expert panel discussed how insurance businesses are adapting the personal development of their employees during a time of remote working; and what the implications are for future…

LV, Zurich, Hiscox and Davies Group discussed how automation-driven claims could become a greater USP in the battle for consumer hearts, minds and wallets

It has never been more important for insurers to fine tune and promote the claims journey as a unique selling point. So how can intelligent automation be a fantastic tool in building trust in an insurance brand?

Co-op Insurance, National Body Repair Association, The AA and Ageas discussed how insurers can build a more sustainable approach to motor claims

The issue of using reclaimed parts has been ongoing among motor insurers, manufacturers and salvage companies for years. While there has been little traction to use them as an alternative to traditional new parts, things could be set to change