Elite Insurance

FSCS general insurance compensation falls as shadow of Enterprise's collapse recedes

The cost of compensating customers of failed general insurance companies through the Financial Services Compensation Scheme has fallen for a second year running, with both the scheme’s GI provision and distribution classes seeing reduced payouts year-on-year.

Insurance Monitor: Brexit: finding corridors of deviation

In this month's column, David Worsfold, a long-running commentator on the insurance market, explores how the insurance industry could find itself rather lonely in its corridors of deviation after Brexit is finalised, the complexities of Covid-19 for the…

Elite Insurance goes into administration

Gibraltar-based Elite Insurance has been placed in administration and has ceased playing claims, having initially ceased writing business and entering runoff in July 2017.

Elite shoots for solvent scheme to avoid liquidation

Elite Insurance has proposed a solvent scheme of arrangement, in order to avoid a liquidator being appointed.

Analysis: What happened to CBL Insurance?

Last month once again saw a passported insurer placed into liquidation, with the collapse of CBL causing ripples throughout Europe

Alpha Insurance in liquidation, blames CBL

Alpha Insurance has placed itself into solvent liquidation as a “direct consequence” of the failure of CBL Insurance.

Armour acquires Elite Insurance

Armour Group has completed its acquisition of Elite Insurance.

Capsicum's Chris Hardcastle on the capacity struggle facing MGAs

Managing general agents are popping up all over the place but capacity is coming under pressure. Chris Hardcastle, managing director of Capsicum Delegated Authority, asks if there is enough capacity to go round.

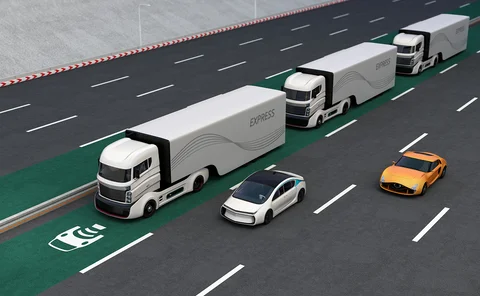

This Week in Post: Is there a driver on board this truck?

Living in South London, I’m in an on-off relationship with my broadband connection. My unreliable web access is irritating – although it is probably not as bad as in certain rural areas.

Elite Insurance falls £9.7m short of SCR

Gibraltar-based insurer, Elite Insurance has fallen £9.7m short on its solvency capital requirement in the year to 31 March 2017, despite a sizeable strengthening in its reserves.

Elite took regulator to court in lead up to closure

Elite took Gibraltar’s insurance watchdog to court in the lead up to its closure, it has emerged.

Week in Post: Brexit, redundancies and consolidation

This week we saw the ‘Great Repeal Bill’ being introduced to Parliament, a key waystone on the long and arduous journey to leaving the European Union.

Elite's rating likely to be downgraded as it goes into run-off

Gibraltar-based Elite Insurance's Insurer Financial Strength rating has been scored as BBB, on Rating Watch Negative.

Elite ceases writing new business

Elite Insurance will cease writing new business with immediate effect.

FM Global chooses Luxembourg for post-Brexit hub

FM Global has been granted a license to operate in Luxembourg as the commercial property insurer looks to establish a post-Brexit base on the continent.

Previously unrated Elite assigned BBB- rating by Fitch

Previously unrated Elite Insurance has been assigned an IFS rating of BBB- by Fitch.

Did the Gibraltar regulator miss the warning signs?

The Gibraltar Financial Services Commission has once again fallen under scrutiny after Enterprise Insurance became the third major insurer to collapse in the tax haven in recent years.

Elite to set up office in Luxembourg to counter Brexit fears

Gibraltar-based Elite Insurance said it will set up a new regulated insurance company in Luxembourg to ensure that it would not miss out on passporting rights following Brexit.

Elite Insurance to redomicile from Gibraltar following Brexit

Elite Insurance will be looking to establish new headquarters outside of Gibraltar following the UK’s decision to leave the EU.

Elite to stop writing solicitors' PII as falling rates take a toll

Unrated carrier Elite Insurance is withdrawing from the English and Welsh solicitors’ professional indemnity insurance market.

Elite follows Helphire in exiting 'commercially unviable' GTA

Elite Insurance Company has withdrawn its subscription to the General Terms of Agreement, with the insurer’s CEO describing the cost benefit of using the agreement as “commercially unviable”.