Flooding

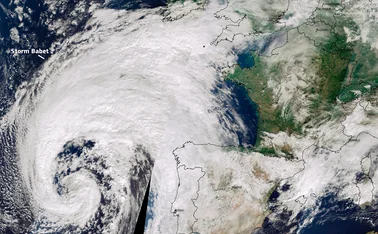

More claims expected from Storm Éowyn after 800% initial spike

Storm Éowyn caused an eightfold increase in claims notifications within an hour of hitting Northern Ireland last week, loss adjuster Crawford has reported.

Biba’s manifesto demands regulator to raise its game

The British Insurance Brokers’ Association launched its manifesto for 2025 today (15 January), titled ‘Partnering to deliver value’. Scott McGee breaks down the main points, including tougher scrutiny on the regulator.

At least 7,000 buildings hit by Midlands floods

At least 7,000 buildings have been affected by flooding across the East Midlands earlier this week, according to satellite monitoring firm Iceye.

Impact of RSA’s withdrawal on home insurance market

The UK home insurance market has seen a steady decline in both provider brands and product numbers over the last 10 years, according to Angela Pilley, insight consultant for general insurance at Defaqto.

Price of motor and flood reinsurance falls for UK insurers

Ample reinsurance capacity meant UK insurers buying reinsurance cover during the busy 1 January renewal period enjoyed price reductions in some cases, according to a Gallagher Re report.

Tributes pour in for flood risk expert killed days before Christmas

Tributes from colleagues and friends in the industry have started pouring in for a flood risk director who was tragically killed just days before Christmas.

Insurers Review of the Year 2024

Insurers share their highlights of 2024 and hopes for more economic stability, less regulatory tinkering and fewer storms in 2025.

Ageas's Linklater on climate changing the role of insurers

View from the Top: Ageas UK claims director Stephen Linklater says that more frequent extreme weather events is broadening insurers’ responsibilities.

Broker Review of the Year 2024

Brokers were pleased with M&A activity in 2024 but ticked off by disproportionate regulation, capacity exiting the market and artificial intelligence failing to live up to expectations.

ABI’s Clark says insurers can’t tackle climate change alone

Trade Voice: As the UK's extreme weather problem worsens, Louise Clark, general insurance policy adviser at the Association of British Insurers, calls on the government to take action.

Labour’s building ambitions fail to factor in insurance

The government’s overhaul of the planning system to accelerate housebuilding and deliver 1.5 million homes over this parliament has been slated by insurers for failing to consider flood risk.

Why I’m dreaming of subsidence this Christmas

Editor’s View: Rather than our days being merry and bright, this Christmas looks set to be wet and windy rather than white, causing Emma Ann Hughes to dream of subsidence rather than snowman building this December.

Environmental Audit Committee launches flood resilience inquiry

The Environmental Audit Select Committee has launched an inquiry to identify how to boost England’s flood resilience.

Biba’s Trudgill on managing change

Trade Voice: Looking ahead to 2025, British Insurance Brokers’ Association CEO Graeme Trudgill says brokers should see enormous changes on the horizon as an opportunity rather than a threat.

Storm Bert shows insurers must demand building rules change

Editor’s View: If you want to know why people recoil, rather than embrace you, when you say you work in insurance, Emma Ann Hughes recommends you type into Google: ‘What does the insurance industry need to do about the growing number of named storms?’

Property payouts hit £4bn; RSA's latest launch; Konsileo's £8m fundraise

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Mitigation for the UK’s worsening mould problem is critical

With mould remaining a major issue in the UK and expected to worsen, Alan Smith, head of mitigation at McLarens, argues it’s critical both policyholders and their insurers understand the causes of the fungi and how to address plus prevent it.

Are higher home excesses killing smaller claims?

After Verisk saw a 17% increase in the average home insurance claims cost, due to a decline in the number of low-value claims submitted by policyholders, Scott McGee asks: what is causing customers to stop submitting small claims?

Seven takeaways for the insurance industry from Labour’s Budget

Chancellor of the Exchequer Rachel Reeves delivered the hotly anticipated first Budget of the new Labour government on Wednesday afternoon. Insurance Post picks out the most eye-catching points for the insurance industry.

Radar satellites promise to transform insurer flood responses

Space technology company ICEYE’s constellation of radar-equipped satellites gives insurers the ability to have a more informed response to floods just hours after they occur, its global head of insurance Stephen Lathrope has said.

Storm damage behind one in five of Aviva’s home claims

Aviva has revealed that 19% of all UK home claims between 2020 and 2024 were related to storm damage.