Lust for trust: can public trust be restored in insurance?

Need to know

- Insurance should be there for each and every one of us, every step of our way

- Building trust takes time and money

- 60% of people believe CEOs should lead change

Nick Marson, founder of Parallel Mind, talks to commentators from across the insurance market to garner their views of how the insurance market can respond with one collective voice to meet the challenge of restoring public trust

In the 21st century, the world’s most precious resource is trust. When a brand is trusted, people pay more, come back and tell others. The price of operating the insurance business is trust. Customers have a lust for trust, yet insurance is low on the trust scale.

“Public trust is at the heart of all we do, the reason we exist and core to our rich heritage,” says Sian Fisher, CEO of the Chartered Insurance Institute. “We have separated ourselves from our customers. We have lost the human narrative of a shared life journey with all its risks, twists and turns. Insurance should be there for each and every one of us, every step of our way.”

Fisher’s challenge is a fair one: if insurance is to really be accessible to all, the insurance industry needs to build bridges to the public it serves and adopt language that is simple, direct and empathetic. Policyholders want to feel fully heard and understood. Flood victims want the claims adjuster to listen to their story, show empathy and feel their pain, not get out a calculator.

The challenge is a complex one, as building trust takes time (and money) – and that trust can also be easily lost, as the recent Facebook data harvesting scandal amply illustrates. Trust is, however, central to insurance, as the customer – be that an individual or a business – has to trust that their insurer will honour its commitment at the time of the claim with delivery on the promise.

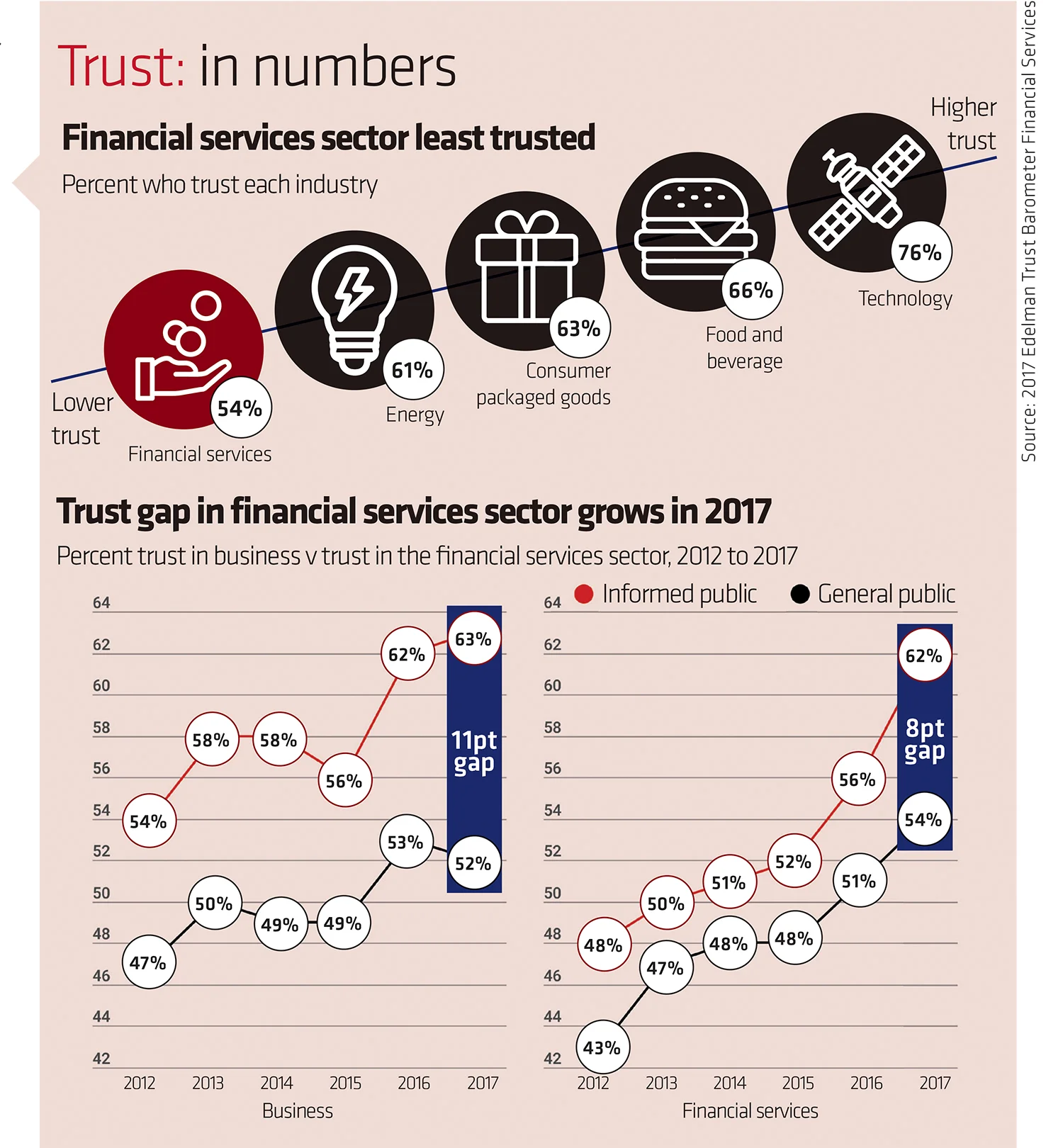

The 2018 Edelman Trust Barometer saw trust in UK business fall to 43%, with 45% of people saying business does not operate in a transparent and honest way and 60% saying CEOs should lead change, rather than wait for regulators to impose it.

Insurance has trust at its very heart and is bought with a view to it never being used – but when it is, it is usually at a time of distress. Outside of renewal, most customers rarely hear from their insurer and there are presently fewer opportunities or touch points to build trust than in other financial services such as banking.

And insurers don’t help themselves, as the Financial Conduct Authority has highlighted over its belated interest in dual pricing. How can the customer trust an insurer that offers a lower premium to a new customer than to a loyal customer who, in all likelihood, has never made a claim? And can you trust a broker that doesn’t tell you what he is being paid by the insurance company to sell its products? This market practice, in addition to price sensitivity, also undermines customer trust.

Michael Sicsic, head of consumer general insurance at the FCA, is keen to see better transparency across the industry: “The lack of transparency in commissions causes confusion with consumers.” This means it is not easy to compare products from different providers.

“Trust in the transparency of insurers’ business model is a key factor in building business partnerships,” adds Julia Graham, deputy CEO and technical director at the Association of Insurance and Risk Management.

Transparency is a key component of trust and while there are financial consequences to greater transparency, an ethically healthier and more trusted industry should create bigger opportunities for all the players. If the industry doesn’t self-regulate, it faces the prospect of ever-invasive regulation in the future. An example of this was the Insurance Act 2015, which made several key changes enforcing the duty of disclosure in commercial policies.

Transparent, ethical business and authentic leadership are needed if trust is to be restored with the public. Leaders always have choices, insists Ashton West, CEO of the Motor Insurers’ Bureau: “Just because you can, doesn’t mean you should. Ethical business is sustainable business.”

Some in the market believe that more widespread adoption of chartered status, presently overseen by the CII, is a key part of driving professionalism across the industry. In the UK, there are still many insurers and brokers that do not have chartered status.

John Moore, chairman of Thomas Carroll Group, and past president of the CII, made “choosing chartered” his main presidency message: “I believe chartered status raises our professionalism to a gold standard and that has to be in the best interests of the public. I became chartered as soon as I could and then took the three parts of my business through the process of gaining corporate chartered status. The ethical standard it sets also challenges you to make good judgements about your clients, and how you run your business.”

Philippa Foster Back, director of the Institute of Business Ethics, agrees: “Education is a key element in rebuilding trust, through embedding values and behaviours in professionals and firms.”

Lack of diversity

Diversity – or rather lack of diversity – is also an issue hampering trust, according to Tangy Morgan, senior advisor for the Bank of England at the Prudential Regulation Authority: “The voice of the customer must be heard in the boardroom. Board representation should reflect the diversity of customers and employees. Board members must be ethical, accountable and accessible.”

The challenge for board members is to start succession planning that embraces diversity. Morgan’s view is that change has to start at the top, and by implication the challenge to restore trust in the insurance industry has to start with the authentic voice of its leaders.

Leaders need to ignite a common sense of shared purpose – need to engage employees, especially millennials, and give them a sense of purpose and connection. Nick Frankland, CEO at Aon Benfield, explains: “There is a disconnect between the industry top heavy, 45-55-year-old managers and the under-30s they manage. We need to provide pastoral care to this new generation of leaders.” The reality is that by 2020, half of the workforce will be millennials.

According to research from the Gallup organisation, more empowered employees give more personal service to customers. Putting a smile back on employees’ faces puts a smile back on customers’ faces. Insurers need to heed this insight and build a better working world, says Tony Sault, executive director for general insurance at EY: “Better relationships; better engagement; better accountability; better leadership – all add up to a better customer experience.”

And diversity is also key to meeting the challenge laid down by Fisher that insurance should be accessible to all. Risk is diverse, and a more diverse industry will understand risk better to serve society better. Samantha Eustace, public affairs and communications assistant at Zurich, adds: “We are often behind the curve on topical issues and responses to these. Matters such as mental health, workplace wellbeing, diversity and inclusion all need more promotion and more sustainable actions taking place.”

Dominic Christian, UK CEO for Aon, agrees: “The industry needs to embrace diversity better to understand risk better. Insurance should be less grey and more contemporary, more colourful, more visual, more alive, and more accessible.”

Huw Evans, director general of the Association of British Insurers, believes this would make it easier to provide for the whole population: “We should do more to provide non-standard covers for vulnerable customers like those with special needs, who find it difficult to get adequate cover.”

If the insurance industry is to tackle the protection gap, it needs to design a new social contract that reaches out to all parts of society – the young, the old, the disadvantaged, people with learning difficulties, those with mental health issues. Stories like that of a policyholder who suffers from cerebral palsy and managed to get appropriate travel cover, through a broker, for his trip to Italy to play for a professional wheelchair basketball team, should be the rule not the exception.

And the issue of trust is not just limited to the UK. Insurers attending the International Cooperative and Mutual Insurance Federation conference last October heard repeatedly that winning trust was the key to closing the ever-growing protection gap and that the industry needs to better communicate its societal value.

Steve White, CEO of the British Insurance Brokers’ Association, underlines this point: “There needs to be a clearer explanation of what is covered by an insurance policy. The average reading age in the UK is 12, but you need a degree to read most insurance policies.”

Public awareness

A common theme emerging from all of those interviewed is the need for a massive public awareness campaign on the positive contribution insurance makes, to put a human face on insurance and advertise the fact the vast majority of claims are paid out. In other words, to develop a common narrative that makes insurance friendlier, more accessible, relevant, empathetic and expansive.

Jon Dye, UK CEO of Allianz, for example, says he would like to see more positive stories: “Like the insurance market response to the floods in December 2015 – surge plans, quick responses, people on the ground, interim payments, tiny claims declinature rates, very few complaints, and a quiet media. These all contributed to a total industry transformation of the poor insurance market showing to the wind storm in 1987. However, the industry is poor at capitalising on the good news.”

“Big personalities should step out, get on the road, be proactive and confident,” he urges.

“We need to step up, step out, show up and shout out,” confirms Peter Blanc, group CEO of Aston Lark. His comments are also supported by Kevin Thomson, CEO of Insurance Ireland, who adds: “We need the public to know who we are and what we stand for as an industry.”

But in facing the future, the industry must embrace its past and where it has come from, as Tulsi Naidu, CEO at Zurich UK, points out: “Honest principles, transparency and protecting customers are what makes insurance a noble profession.” The purpose of insurance, of taking risk away and protecting customers, is as important today as it ever was.

Despite this common wish for a united, collective and positive voice, the insurance industry is by its nature fragmented, competitive and conservative. But if the market is to really address the issue of trust, it is a nettle that needs to be grasped, believes Craig Tracey MP, chair of the All-Party Parliamentary Group for Insurance and Financial Services, and a former insurance broker owner. “There is a lack of getting positive stories out,” he agrees. “The industry needs to reach out to the people and find new ways of connecting.”

The big question is: can the insurance industry’s leaders swap rhetoric for action and rise to Tracey’s challenge to get the ball well and truly rolling towards the industry as a whole restoring public trust and pride in insurance?

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk