Opinion

How Link’s co-founder was warned being gay would hinder his career

Erik Johnson, active underwriter at MIC Global Syndicate 5183, on the prejudice he faced as a gay man entering the insurance industry and how he ignored warnings pushing for inclusion could hinder his career to co-found Link.

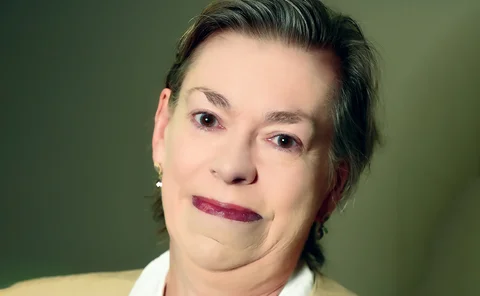

Sedgwick’s Armstrong on bringing your authentic self to work

Suzanne Armstrong, deputy head of key accounts at Sedgwick in the UK, on how a female colleague being denied compassionate leave spurred her on to be her authentic self at work and break down LGBTQ+ barriers.

Tapoly’s Kaenprakhamroy challenges the male-dominated insurtech sector

Janthana Kaenprakhamroy, CEO and founder of Tapoly, on the barriers she faced as a woman trying to launch an insurtech and how diversity and inclusion needs to become deeply ingrained values in the industry.

Verlingue’s Amin on why insurance failed to attract Muslims

Sakib Amin, head of insurance broking at Verlingue, shares his experience as a Muslim, British Asian working in the industry and why there is still a long way to go before the market fully embeds inclusivity into its practices.

How Johnny Timpson refuses to let disability define him

Former Cabinet Office Disability Ambassador Johnny Timpson and winner of Insurance Personality of the Year at the British Insurance Awards explains how he works with a musculoskeletal impairment plus his neurodivergence to make the industry more…

AmTrust International’s Challis on supporting mothers working in insurance

Helen Challis, group head of human resources at AmTrust International, shares the wrench of returning to work after maternity leave and what she is doing to help to make the sector more inclusive.

Kim Alcock of McLarens fights for a more fair world

Kim Alcock, head of UK casualty at McLarens, shares how she has gone from being told the role of claims inspector was "not open to women" to leading one of the most gender diverse adjusting teams in the market.

View from the Top: Bspoke’s Tim Smyth on inflation challenging MGAs

Tim Smyth, CEO of Bspoke Group (formerly UK General), says MGAs need to make their voices heard and engage regulators and policyholders on the challenges facing the sector.

How AI can mitigate increasing cost of extreme weather

Izik Lavy, CEO and co-founder of GeoX, discusses how insurers are using AI and aerial imagery to battle the extreme weather ushered in by the climate crisis.

Trade Voice: Biba’s Trudgill on scanning the horizon

Graeme Trudgill, CEO of the British Insurance Brokers’ Association, says brokers need to anticipate the products clients of the future will need.

Is remote working right for the insurance industry?

Editor’s View: Following the firing of an insurance employee whose keystrokes showed she wasn’t working enough from home, Emma Ann Hughes considers whether remote working is suitable for fresh entrants to the industry.

A fire-free summer does not call for complacency

Paul Redington, regional major loss manager of Zurich, explains why insurers and the government should work together to create a risk map of areas vulnerable to wildfires.

How big data and AI could slash insurance costs

Alex Holdsworth, executive strategy director at Monsterlab, explains how by harnessing the power of big data and AI, insurers can encourage healthier habits to reduce claims and cut costs.

Trade Voice: Ajay Mistry on why networking is more important than ever

Ajay Mistry, founder of Gambit Partners and an advisory board member of the Chartered Insurance Institute’s broking community, outlines seven reasons why networking is crucial for insurance brokers.

Does travel insurance need a revamp?

News editor view: After recent travel stories made front page news, stranded travellers were left without much hope for financial compensation. Could this have been an opportunity for insurance to step in?

View from the top: Aon’s Helen Payne on human sustainability

Helen Payne, UK director of human sustainability at Aon, outlines what steps firms are taking to look after their employee's wellbeing.

Unveiling the future of commercial insurance: education, engagement and technology

In the second instalment of the research series by Insurance Post and Crif, we explore how education, engagement and technology converge to shape a resilient future for commercial insurance.

How the circular economy will change insurance

As more manufacturers become involved with recycling and sustainable production, Brian Rainbow, UK property and package segment leader at CNA Hardy, considers the implications of the circular economy for the insurance industry.

Trade Voice: Cila’s Marc Sweeney on navigating the evolving landscape

Marc Sweeney, president of the Chartered Institute of Loss Adjusters and director at Davies, says the professional body has a critical role to play in helping its members navigate challenges.

Insurers should stop boasting about paying 99% of claims

Insurers need to stop advertising themselves as being a panacea and be honest with customers if the industry is to be trusted, according to James Daley, managing director of Fairer Finance.

Briefing: DLG has its CEO, so what next?

Direct Line Group has finally announced who will be taking over the permanent role of CEO. But how big of a task is on Adam Winslow’s hands when he takes over in 2024?

Why claims don't get better with age

Bill Brower, vice president of industry relations at Solera, explains why touchless claims could prevent the collateral damage caused by a claim failing to be quickly attended to.

Trade Voice: Mass’s Brown on whether whiplash reforms were worth it

Sue Brown, chair of the Motor Accident Solicitors Society, asks whether motor policyholders will ever see a ‘whiplash dividend’.

Addressing the biodiversity crisis in underwriting

Cody Dong, senior associate, and Arne Philipp Klug, vice president of MSCI Research, explain how insurers can take steps to reduce the risk of losses from deforestation, land-use change, overfishing, pollution and the introduction of invasive species.