Legal

Insurance reflects on two years of the OIC portal

Today marks two years since the Official Injury Claims portal was launched. Industry experts react to the progress the portal has seen, teething troubles it has overcome, and what is still in need of work.

Deadline for the 2023 Claims & Fraud Awards days away

The deadline for the 2023 Claims & Fraud Awards is just days away if you want to be in the running to win one of these prestigious prizes [5pm on 2 June].

Media risks in the digital age

Analysis: David Worsfold examines the implications of the Online Safety Bill for insurers of content creators, publishers, website hosts and social media platforms.

Arc Legal considers expansion into new lines

Arc Legal bosses reveal plans to provide total ancillary insurance cover as celebrates 20 years of operation.

Renters Bill gives bad tenants more power to play system

Richard Finan, director of strategic development for legal expenses and rent guarantee insurer Arc Legal Group, struggled to see many positives when it came to the newly published Renters (Reform) Bill.

Why landlords need higher limits on liability cover

Chris Murray, partner in the Manchester office of Clyde & Co, warns the severity of landlords’ liability claims has increased, leaving them exposed to potentially catastrophic costs and unable to purchase sufficient coverage.

Ardonagh in double swoop; UK General rebrands; SRG launches in Europe

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments, and strategic moves of the week.

Excel Centre accuses insurers of re-running settled arguments in Covid BI trial

The Excel Centre has accused its insurers of seeking to rerun arguments previously settled by the Supreme Court in its 2021 Covid business interruption test case judgment.

Entries open for the 2023 Insurance Claims and Fraud Awards

The 2023 Claims & Fraud Awards are open for entries with a deadline of 5pm on 2 June.

Law firm Ince enters into administration

Law firm Ince Group, previously known as Ince Gordon Dadds, is set to appoint administrators after a major creditor withdrew its support following months of cashflow problems.

Trade Voice: Bila’s Brooks on why ‘policyholders good, insurers bad’ attitudes don’t wash

Dan Brooks, British Insurance Law Association committee member, and policyholder coverage lawyer at Wynterhill LLP, discusses why tribalism in the claims sector does not help the insurance industry in the long-run.

Exeter University bomb damage excluded from cover in Allianz win

The High Court has ruled that damage to buildings at the University of Exeter caused by the detonation of a Second World War bomb in 2021 was not covered by insurance.

‘Major reset’ expected in motor personal injury two years on from whiplash reforms

Minster Law CEO Shirley Woolham said following a complex year that saw industry come out of a pandemic and continue to deal with the aftermath of whiplash reforms, the personal injury motor market is transforming into a different landscape.

Law firm reprimanded after criminal employee defrauds Aviva

Harwood has been found liable for losses, damages and costs incurred by Aviva after recruiting a solicitor with a criminal record.

Insuring the new working world

Sam Barrett explores how the insurance industry is adapting employers’ liability insurance to reflect the risks associated with new ways of working post-Covid.

Trade Voice: Apil’s Kim Harrison on why the time bar on childhood sexual abuse claims needs to be lifted

Kim Harrison, executive committee member at the Association of Personal Injury Lawyers, argues that an independent inquiry’s findings makes it clear the limitation period on childhood sexual abuse claims should be abolished.

Justice minister refuses to commit to regular fixed recoverable costs reviews

Justice minister Lord Bellamy has refused to commit to regularly updating new or existing fixed recoverable costs (FRCs) for inflation, but confirmed an extension to FRC will be going ahead in October.

Climate litigation on the rise as Shell is sued

Kennedy’s partner Alex Nurse expects climate litigation to be on the rise as Shell is facing a legal battle filed by shareholders for its failure to adopt and implement an energy transition that aligns with the Paris Agreement.

SMEs continue to fight for BI payouts as unresolved issues await litigation

Three years on from the onset of the pandemic and more than two years on from the resolution of the Financial Conduct Authority’s initial test case, many small businesses remain embroiled in disputes with insurers over Covid business interruption claims.

What goes around is coming around on leaseholder insurance fees

News Editor's View: Scott McGee warns insurers and brokers that the ‘huge scandal’ of leaseholder insurance fees could be coming back to haunt them.

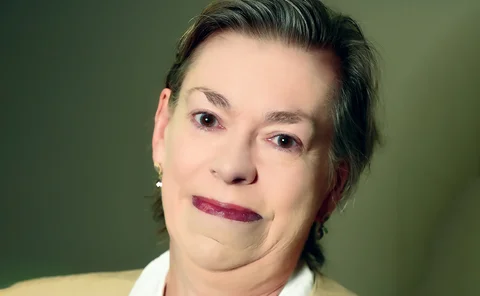

Trade Voice: Mass’s Sue Brown on why the OIC portal has been a resounding failure

Sue Brown, chair of the Motor Accident Solicitors Society, argues that the criteria by which the success of the Official Injury Claims portal has been judged have continually shifted and takes aim at what she sees as the MoJ’s latest excuse.

Scale of underinsurance in cyber uncovered

Data analysis: Insurance Post investigates whether fewer incidents of data breaches are linked to the rise of cyber insurance and if policyholders have adequate cover for their needs.

Is Tesla's imminent UK insurance entry the 'revolution' that has been threatened?

Analysis: After Insurance Post reported Tesla had submitted Companies House listings to set up an in-house insurer in the UK, we examine is this good or bad news for electric vehicle drivers?

What next for the Covid business interruption insurance saga?

In light of recent FCA’s review into the handling of Covid business interruption claims, Peter Hardy, insurance expert and partner at Reed Smith and Mark Pring, partner at Reed Smith argue that the legal fallout only just begun.