Motor

Motor to return to profitability in 2024

Data Analysis: The latest Oxbow Partners motor insurance report proves to be encouraging reading for those operating within the space.

What is going on with electric vehicle insurance?

Post Podcast: What pushed up the price of electric vehicle insurance plus the steps providers are taking to ensure premiums are affordable is the topic of the latest Insurance Post Podcast.

How Labour could reduce the cost of motor insurance

Analysis: Emma Ann Hughes examines efforts by the industry to push down motor insurance premiums and whether politicians could force providers to take more extreme action.

Big Interview: Geoff Carter, Sabre

Geoff Carter, CEO of Sabre Insurance, sits down with Tom Luckham to discuss Sabre’s 2023 results, why there’s no such thing as an uninsurable car, and how the insurer plans to do even better in 2024.

Insurers face margin crush unless premiums are hiked

Data analysis: A sustainable margin recovery looks increasingly challenging for insurers with premiums needing to increase in real terms to prevent any erosion after a tripling of costs to 10.9% of premiums last year from 3.5% in 2022.

Electric opportunities for total loss claims

Collaborative partnerships between insurers and replacement vehicle suppliers can help smooth the transition to zero emissions, as James Roberts, head of insurance sales for Europcar explains.

Winslow continues Direct Line management overhaul

Direct Line Group CEO Adam Winslow has continued his makeover of the insurer’s management team, appointing a new managing director of motor and chief strategy and investor relations officer.

Exploring the ethnicity penalty in insurance

As the insurance industry is once again accused of discriminating against individuals living in ethnically diverse areas, Aamina Zafar considers whether providers should do a better job of demonstrating racism isn’t a factor in pricing policies.

Mass’s Sue Brown on why the whiplash tariff should be reviewed annually

Trade Voice: Sue Brown, chair of the Motor Accident Solicitors Society, says annual reviews need to be introduced at the earliest opportunity to address the perhaps irreparable damage done by the 2018 reforms.

Movers and shakers who made Insurance Post’s Power List 2024 revealed

This year’s Insurance Post Power List reflects how claims inflation combined with the Consumer Duty caused some providers to shift their focus and disruptors found it is easier to send a rocket into space than enter the UK insurance market.

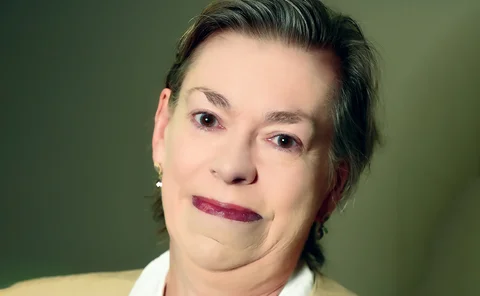

Donna Scully, Carpenters Group

Donna Scully is a joint owner and director at Carpenters Group, plus a skilled Irish dancer – as demonstrated on the stage of the Royal Albert Hall at last year’s British Insurance Awards.

Hannah Gurga, Association of British Insurers

Hannah Gurga, director general of the Association of British Insurers, maintains her 18th position on the Insurance Post’s Power List thanks to her efforts to prove the industry’s worth to whoever will occupy 10 Downing Street later this year.

Tim Bailey, Zurich

Tim Bailey was named president of the Association of British Insurers in summer 2023 and has been CEO of Zurich UK since 2021.

What it takes to be a Power List player in 2024

Insurance Post’s Power List reveals today’s leading lights in the industry, the demise of big name digital disruptors plus who has shaken up the market in the last 12 months.

First Central cautiously enters home insurance market

First Central has launched a home insurance product line, with the firm planning to take a “cautious approach” to building its book.

Ageas’ sustainability workshop; Addept acquires Policywise; Co-op’s renters insurance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Former colleagues pay tribute to David Sweeney

Former colleagues of ex-Hiscox, Sterling and Brightside manager David Sweeney have paid tribute to him after he sadly passed away at the end of last month.

Automated Vehicles Bill finally passes through Parliament

Insurers have stated the passing of the Automated Vehicle Bill today represents a "significant step forward" but warned they need "access to relevant data in order to support the adoption of this technology.

Repair costs continue to push up home insurance premiums

According to the Association of British Insurers’ premium tracker, home insurance premiums increased 3% in the first quarter of 2024, following a severe winter for weather damage.

Cytora to streamline ‘time-consuming’ data gathering within large fleets

Cytora has partnered with risk management platform SambaSafety in a bid to streamline workflows and improve risk selection of motor insurance for large fleets.

MoneySupermarket and Auto Trader partner; Axa extends Liverpool sponsorship; MIB appoints CFO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Keoghs and LV crash fraudulent street racer's claim

Keoghs and LV have saved £135,000 in a fraud case where the claimant was found to be street racing, and taking part in a joint criminal enterprise.

FCA warns against Tempcover clone targeting TikTok

The Financial Conduct Authority has issued a warning on fraudsters claiming to be FCA-authorised firm Tempcover, claiming to be the short-term insurance specialists on TikTok.

Esure restores direct motor business

Esure has re-established its capacity to offer motor insurance quotes directly through its website following a planned six-week outage.