SME

Insurers criticised for furlough payment deductions from BI claims

Insurers have been accused of “banking government money to reduce their loss by increasing the policyholder loss” as they faced criticism for deducting furlough payments from the value of business interruption claims.

Interim payments expected for BI policyholders with Marsh-authored RSA wording

Some businesses with policies that employ a Marsh wording can expect interim payments “imminently” following RSA’s decision not to appeal a High Court judgment, which found it provided cover for disruption caused by the coronavirus pandemic.

Other insurers unlikely to intervene after RSA declines to appeal 'outlier' Marsh BI wording, say lawyers

RSA’s decision not to appeal the High Court’s rulings with regards to a widely-used Marsh wording is unlikely to result in another insurer launching an appeal of its own, with would-be interveners facing significant hurdles according to lawyers.

Briefing: ERS' commercial push - a perfectly timed diversification

With the news that ERS is planning to enter 'specialist commercial' lines, Post content director Jonathan Swift asks if we can get any insights into what that might mean by looking at previous diversification plays, recent appointments and its IT…

Analysis: Lockdown legionella threat a public health and liability concern

Specialists across the insurance industry have voiced their concerns about the potential for a build-up of legionella bacteria in buildings left empty over lockdown.

Mike Keating keen to grow insurer member levels at MGAA

Recently appointed managing director of the Managing General Agents’ Association Mike Keating has set out his vision for the association with growth of insurer partners high on the agenda.

Fully Comp Episode One: How ready is the UK for future flood events?

Welcome to the first episode of Fully Comp, Insurance Post’s new regular video series tackling some of the biggest issues in insurance.

Pool Re urges insurers to support a 'vibrant' terrorism insurance market

Pool Re has published a forward-looking strategy looking at increasing the take up of catastrophe insurance by SMEs in light of current pandemic, ahead of its five-year review.

Insurers to continue BI dispute at fast-tracked Supreme Court appeal

Six insurers and the Financial Conduct Authority have been granted permission to fast-track an appeal of last month’s business interruption test case judgment to the Supreme Court.

Top 100 UK Insurers 2020

The 100 largest UK-regulated insurers reported a combined underwriting profit in 2019, albeit lower than in 2018. Bond yields fell in 2019, however, investment earnings benefited from the strong performance of equity markets. How will the impact of the…

Lloyd's insurers launch parametric product to cover SME IT downtime

Lloyd’s has launched a parametric insurance product to cover SME business interruption losses caused by IT disruption or downtime.

HG to own 20% of Hyperion as investment boosts ‘war chest’ to $1.5bn

When the transaction for HG to invest in Hyperion closes the private equity firm will hold “just over 20%” of the business, CEO David Howden told Post.

A-Plan buy cost 'approaching £700m', Howden confirms

Howden’s purchase of A-Plan for “approaching £700m” has created a business of scale that is a true “challenger broker”, according to David Howden, CEO of Hyperion Insurance Group.

BI judgment welcome news for policyholders but result differs by wordings

Disease and ‘hybrid’ wording policyholders are particularly well placed to seek compensation after the landmark High Court ruling today in the business interruption test case and those with prevention of access wordings may also find they have cover, law…

Lloyd’s sees underlying underwriting improvement as Covid weighs on H1 result

Lloyd’s posted a £438m loss in the first half of 2020 driven by £2.4bn of Covid-19 claims, which added 18% to its combined operating ratio.

Briefing: Do Revolut and Lloyds Bank moves signal a bancassurance renaissance?

The model of banks with in-house general insurance divisions, or bancassurance, has thrived elsewhere in Europe but failed to pick up the pace in the UK. Is this about to change?

Lloyd's Lab - Class of 2020

The fifth cohort of Lloyd’s lab kicks off this week, with the chosen teams set to concentrate on Covid-19 products and solutions. Post looks at the businesses that hope the accelerator will help make their mark on insurance.

Hiscox and action group arbitration to commence following court agreement

Hiscox has agreed to an expedited arbitration process in its dispute with the Hiscox Action Group, a coalition of policyholders that is contesting the insurer’s rejection of coronavirus-related business interruption claims.

NFU Mutual rejects accusation it misbehaved by deducting government grants from payouts

NFU Mutual has defended itself against claims by self-catering accommodation businesses that it is unfairly deducting the value of government grants from coronavirus-related payouts.

McCaffrey targets 10 deals for MVP and Ataraxia

Minority Venture Partners and Ataraxia CEO James McCaffrey is confident the businesses will strike up to 10 deals in the next 12 months, he told Post.

FCA picks apart insurer reliance on Hurricane Katrina judgment in BI test case

On the second day of the Financial Conduct Authority’s business interruption test case, the regulator’s lawyers argued there are key issues with the Hurricane Katrina Orient Express judgment insurers are expected to lean on during the case.

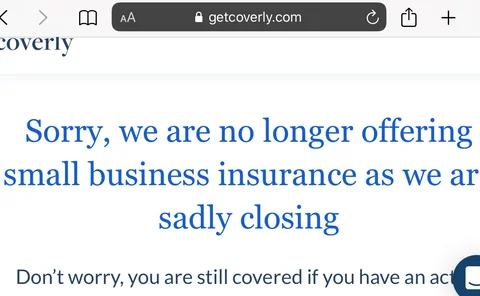

Updated: SME specialist Coverly becomes latest UK insurtech casualty as it closes

SME insurance specialist insurtech Coverly closed for new business on Friday 17 July, Post can reveal.

Insurers haul brokers into FCA BI case again

A joint skeleton argument attacks the FCA’s stance that SME customers are not sophisticated insurance buyers because they used brokers and slams Contra Proferentem as “restrictive” and “out of step”.

Arch tells policyholders BI payments could be 'reduced to zero' if they wait for court judgment

Arch policyholders whose business interruption claims were confirmed to be covered by the insurer have been told that their payments could be “reduced to zero” depending on the outcome of the Financial Conduct Authority's test case.