UK

Big Interview: Louise O’Shea, CFC

Louise O’Shea, group CEO of CFC, sits down with Insurance Post to discuss where the business is heading following its change of management and what the ‘next cyber’ might be.

‘A lot of gaps’ to fill in Automated Vehicles Bill

There are still gaps left to fill regarding the use of automated vehicles, according to the Association of British Insurers’ manager for general insurance policy, Jonathan Fong.

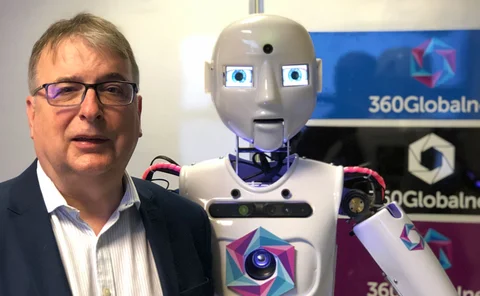

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

AllClear to grow international presence following sale

Chris Rolland, group CEO of AllClear and InsureandGo, has revealed the travel broker’s plans to expand the international business following the sale of owner InsurEvo.

Big Interview: Alistair Hardie, Jensten Group

Alistair Hardie, CEO of Jensten Group, updates Scott McGee on the broker’s anticipated sale, its “radical overhaul”, and where it may shift its M&A focus to in the future.

Hardie sees Jensten ‘doubling again’ in next few years

Alistair Hardie, group CEO at Jensten, has said he expects to complete “about 10” acquisitions in 2024, and that he believes the broker can “double the size again” in three or fours years’ time.

How is insurance stepping up amid election uncertainty?

With a record number of elections in 2024 set to introduce substantial unpredictability into an already volatile risk environment, Edmund Tirbutt examines how insurance is engendering resilience amidst unrelenting geoeconomic uncertainty.

Big Interview: Cécile Fresneau, QBE

Cécile Fresneau, managing director of the insurance division of QBE’s European Operations, reveals her growth plans, hopes for generative artificial intelligence and her efforts to boost the number of female senior underwriters.

Big Interview: Geoff Carter, Sabre

Geoff Carter, CEO of Sabre Insurance, sits down with Tom Luckham to discuss Sabre’s 2023 results, why there’s no such thing as an uninsurable car, and how the insurer plans to do even better in 2024.

Online HNW insurance options not ‘fit for purpose’

The founder and CEO of Rivr, a newly launched firm focussing on HNW home insurance, has told Insurance Post that online options for high to mid net worth customers are “not fit for purpose”.

Jaguar Land Rover offers £150 off new policies

Jaguar Land Rover has announced an “Insurance Contribution initiative”, which provides £150 per month towards the cost of cover for its policies for new Range Rover models.

60 Seconds With... Optalitix’s Dani Katz

Dani Katz, founding director of Optalitix, would like to be the Caped Crusader, keeps on running, and recalls launching Vitality.

MoneySupermarket and Auto Trader partner; Axa extends Liverpool sponsorship; MIB appoints CFO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Esure restores direct motor business

Esure has re-established its capacity to offer motor insurance quotes directly through its website following a planned six-week outage.

Axa reveals how AI is transforming the business

Axa UK & Ireland has 12 “between proof of concept and proof of value” artificial intelligence initiatives currently ongoing across the business, according to CEO Tara Foley.

Urban Jungle to use latest funding to expand product range

Home insurance startup Urban Jungle has raised £11.2M in its latest funding round led by existing investors, including Sony.

RSA ‘pragmatic’ on product review as NIG acquisition completes

RSA intends to “move at pace” and make strides towards going to market with a single set of products by the end of this year following its acquisition with NIG and FarmWeb, Sonya Bryson has told Insurance Post.

Peppercorn accelerates B2B deal after funding round

Peppercorn AI raised £1.25m more than anticipated in its latest funding round, allowing the firm to bring plans for its first B2B deal six to nine months forward.

Home insurance premiums climb by nearly a third

Home insurance premiums increased by 31% between January and March 2024, according to the latest research from Compare the Market.

Big Interview: Jason Storah, Aviva

In his first full profile interview since taking over as UK and Ireland General Insurance CEO at Aviva, Jason Storah sits down with Scott McGee to talk about the insurer's re-entry into Lloyd's, where else Aviva could yet expand, and the differences…

Biba’s EV scheme; Cytora and DynaRisk partner; WTW’s global head of claims

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Motor premiums fall for first time in over two years

Car insurance premiums have fallen by 5% during the past three months, according to the latest data from Confused.com.

Helen Bryant departs Allianz after 23 years

Allianz Commercial’s managing director of digital and legal protection, Helen Bryant, is to leave the insurer after 23 years to “pursue new opportunities”.

Could Jaguar Land Rover issues derail OEM insurance ambitions?

Following customer concerns over Jaguar Land Rover’s embedded scheme, Tom Luckham contemplates whether the original equipment manufacturer-led car insurance revolution is still a distant dream?