Claims inflation

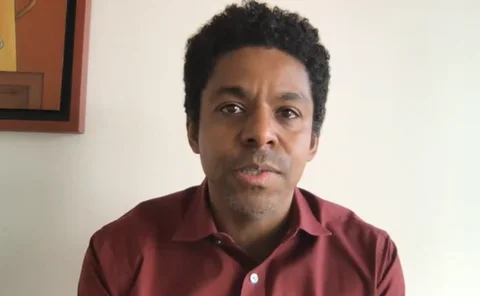

Profile: Rodney Bonnard, EY

Rodney Bonnard, head of insurance for EY, chats to Scott McGee about his 30 years in insurance, the “profitability crisis” within personal lines, and how insurers need to be redefined for the future of insurance.

Insurers must right their wrongs for vulnerable customers, says FCA

Home and motor insurers need to put the “wrongs right” and “improve their treatment” of vulnerable customers as the cost-of-living squeeze continues.

Tough times ahead for motor insurers after ‘worst performing year in a decade’

Motor insurers should expect further losses this year as high inflation and low premium costs continue to hound the sector, reports say.

Bank of England says claims inflation will continue to affect every insurer

The Bank of England has provided feedback to the market from its review on the effect of claims inflation and whether insurers took recommendations on board.

Watch Zurich, Allianz, Markel, Guidewire and SS&C discuss claims inflation

The industry is facing the brunt of rising inflation across most lines of insurance as carriers see claims expenses mounting.

Hastings exposes dishonest solicitor who tried to inflate claim values

HF and Hastings Direct have beaten a claimant solicitor’s attempt to inflate claim values by up to £50,000.

Tackling soaring vehicle repair costs in the motor industry

Pete Thompson, director of product at Motor Repair Network, explores key tactics insurers can employ to streamline claims processes and reduce costs.

Claims Apprentice 2023: Episode six – The Final Interviews

With the three team tasks done and dusted, it is time for the six candidates to come face-to-face with Kennedys’ very own Sir Alan Sugar – Claire Mulligan – and put forward a case as to why they should be crowned the winner of 2023 Claims Apprentice.

Trade Voice: ABI’s Mervyn Skeet on why higher insurance bills may not be the hardest price rises to stomach

Mervyn Skeet, director of general insurance policy at the Association of British Insurers, argues that increasing home and motor insurance premiums need to be seen in a wider context of rising prices.

Simplifai’s AI tool; Howden’s telematics app; A-One joins Brokerbility

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Claims Apprentice 2023: Episode five – Claims Inflation Podcast part two

Having recorded their vox pops this week, things get real as Teams Aspire and Connect go into the studio to record their broadcasts.

Admiral founder warns clock is ticking on car insurance

Henry Engelhardt, founder and former chief executive of Admiral Group, warns the “clock is ticking on car insurance”.

View from the top: Aon’s Walia on making better decisions in uncertain times

Elisha Walia, UK chief of staff and director of UK public affairs at Aon, outlines the chronic risks that businesses need to face up to if they are to thrive in the years ahead.

Claims Apprentice 2023: Episode four – Claims Inflation Podcast part one

With one victory each, the third challenge looks to be vital for Teams Aspire and Connect as the claims apprentices seek to impress Kennedys’ very own ‘Alan Sugar’, Claire Mulligan.

Video Q&A: MRN’s Peter Thompson on the challenges facing the motor repair industry

In the lead up to the 2023 Motor and Mobility Conference, Peter Thompson, director of product at event sponsor Motor Repair Network, sat down with Jonathan Swift to discuss the biggest challenges facing the motor repair industry?

Motor Mouth Podcast: Evolution of sophisticated vehicle data

With the average age of a vehicle on UK roads being nine years, insurers must understand each use case, and the key to that is granularity, explains Lexis Nexis’ Tom Lawrie-Fussey.

Could the PRA soon be knocking on personal lines insurers’ doors?

Editor’s View: 2022 was tough for personal lines, but if you are an insurer who had a particularly difficult year, the Prudential Regulatory Authority could soon be knocking on your door.

CFO reveals how Aviva is combatting claims inflation

Aviva's chief financial officer Jane Poole has revealed how the insurer’s operations are preventing it from falling foul of claims inflation like rival Direct Line Group.

Esure chief says plummeting profits won’t derail digital ambitions

Esure chief executive David McMillan revealed the provider will press ahead with the £140.6m digital transformation programme despite posting a £29.1m loss for 2022.

Ombudsman expects uptick in insurance complaints

The Financial Ombudsman Service expects the number of general insurance complaints it receives to go back to pre-pandemic levels in the year ahead.

Insurance CFOs reveal what keeps them up at night

Data analysis: The insurance industry sees high inflation, a downbeat economic outlook and market volatility as the three biggest threats to profitability this year, according to Moody’s annual survey of chief financial officers from 22 leading European…

Esure bosses blame claims inflation for £29.1m loss

Esure posted a £29.1m loss for 2022 with bosses blaming significant claims inflation, a weak pricing environment, increased weather-related home claims, plus motor claims going back to pre-Covid levels.

Podcast: Lessons the insurance industry learnt from Covid-19

The industry has learnt to communicate more clearly what is and isn’t covered by insurance policies, according to the Association of British Insurers, Allianz and Genasys.

Direct Line posts £45m pre-tax loss as operating profit crashes 95%

After a well-documented difficult first three months of the year for Direct Line, financial results for 2022 show just how tough last year was.