Tax

Biba calls for IPT cut to 10% with 2022 manifesto launch

The British Insurance Brokers’ Association has urged the government to cut Insurance Premium Tax to 10% in the next budget and pushed for targeted relief for three areas.

Biba takes aim at weight of regulation and broker FSCS costs

The British Insurance Brokers’ Association has put regulatory and Financial Services Compensation Scheme reform in the crosshairs as it called for a cut in insurance premium tax in its manifesto.

Intelligence: Insuring the growing US cannabis market

Last year Malta became the first European nation to legalise cannabis after the United Nations reclassified the drug to recognise its therapeutic uses and – with other EU countries looking to follow suit – Post spoke to the specialists striving to meet…

Allianz in regional commercial restructure; GRS extends global reach with adjuster tie-up; Movo buys three; and Tractable strikes two new deals

For the record: Post wraps up the major insurance deals, launches and investments of the week.

HMRC's IPT decision hailed as good news for brokers

Her Majesty’s Revenue & Customs has opted against making brokers liable for any unpaid Insurance Premium Tax where they used IPT unregistered insurers and against introducing IPT on brokers’ administration fees.

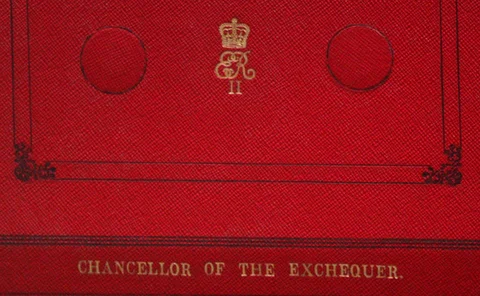

IPT untouched in Autumn Budget

Insurance premium tax went unmentioned in the Autumn Budget announcement.

A tale of two countries encountering retirement income needs

In the second Market Insight piece by Insurance Post's sister expert research brand Chartis, its research director, wealth management, Denise Valentine looks at how the UK and US authorities are taking steps to encourage people to plan and invest for…

Analysis: The CMCs out of scope

When the Financial Conduct Authority took over claims management company regulation in 2019, it fired warning shots at the sector. Should the regulator’s remit be widened to cover those firms that don’t come under its surveillance?

Briefing: From Who Evans? to Huw Da Man - How the understated DG made his mark at the ABI

As Huw Evans plans to step down as director general of the Association of British Insurers to join KPMG as a partner at the end of the year, Jonathan Swift looks back at his time at the trade body and assesses how he has helped both modernise it and keep…

Biba 2021: Key takeaways from John Glen's appearance

John Glen MP, Economic Secretary to the Treasury, tackled insurance premium tax, broker Financial Services Compensation Scheme levies, cladding, Brexit and more in his keynote address to the British Insurance Brokers’ Association’s 2021 conference…

GRP’s Stephen Ross on why sometimes selling your house is like selling your broking business

After looking at over 100 potential deals last year but only striking a small proportion of them Stephen Ross, head of mergers and acquisitions at Global Risk Partners, details what brokers considering a sale need to think about.

Gurpreet Johal to lead Deloitte’s global reinsurance and London market team

Deloitte has named Gurpreet (Guru) Johal as UK and global sector leader for global reinsurance and the London market.

Staveley Head administrators reveal £27.7m in claims

Unsecured creditors have submitted £27.68m in claims against motor broker and managing general agent Staveley Head Limited, far in excess of the £9.98m on the company’s books when Duff & Phelps were appointed as administrators in February 2020.

IPT unscathed in Budget with corporation tax set to rise in 2023

Insurance premium tax went unmentioned in the Spring Budget announcement, with developments including additional apprenticeships funding, a furlough extension and a corporation tax hike from 2023.

Consumers put IPT almost bottom of the list for Budget tax rise targets

Exclusive research by Consumer Intelligence for Post has revealed that the UK public would support increases in almost any other tax ahead of insurance premium tax if the Chancellor opts to bring in rises to help pay for the costs of battling the Covid…

Briefing: IPT – good news in the data but reasons for concern remain

The only doubt around the bill to pay for fighting the Covid-19 pandemic is just how big it is, considers Post senior reporter Emmanuel Kenning.

Biba unveils 'resilience' theme for 2021 manifesto

The British Insurance Brokers’ Association has launched its 2021 manifesto with the heading of ‘Resilience’ as it highlighted the ways it said brokers can help as the UK adapts to a post-pandemic normal after Brexit.

Adam Boakes hails opportunities as first joint Ataraxia-MVP broker deal completes

Ataraxia and Minority Venture Partners have facilitated the merger of Altrincham-based Alan Stevenson Partnership and Seacombe Insurance Brokers taking a minority stake in the business.

GRP’s Mike Bruce on broker M&A speeding up in Covid-hit UK

The level of broker consolidation has risen again this year, says GRP’s group CEO Mike Bruce as he predicts more investments to come from long-term investors with vendors keen to sell due to pandemic uncertainty, rumoured tax changes, strong valuations…

ABI calls for annual government flood defence spending to rise to £1.2bn

Jon Dye, the chair of the Association of British Insurers, has called for government flood defence investment to rise to at least £1.2bn a year.

Blog: A quick-fire reshuffle

Post news editor Jen Frost reflects on Sajid Javid’s shock exit as Chancellor and what this could mean for insurance premium tax and the budget.

M&A volume grows in 2019 but mid-sized targets scarce

Exclusive: The number of UK insurance distribution mergers and acquisitions rose from 82 in 2018 to 93 last year, driven by a surge in deals valued under £5m, industry specialists Imas Corporate Finance has revealed.

ABI tracker shows increase in motor premiums as calls for IPT cut amplify

The average cost of motor insurance rose to its highest level in the final quarter of 2019, according to research by the Association of British Insurers.

Budget 2020: What are the Chancellor's options on IPT?

Insurers have ramped up lobbying attempts to convince the government to slice the rate of Insurance Premium Tax. Post investigates why they may well have good reason to be worried it could be cranked up the other way.