Tax

Ex-mutual insurer CEO facing £150,000 fine and ban

The former CEO of a mutual insurer is looking at fines and a ban, following a joint investigation by the Financial Conduct Authority and Prudential Regulation Authority.

Insurtech Inshare targets SMEs to corporates with peer-to-peer launch

Insurtech Inshare is seeking to bring peer-to-peer risk and insurance management to the commercial community as it gears up to launch ahead of the Insurtech Connect event in Las Vegas next week.

Analysis: Is the IPT review another disappointment?

The government has promised to review the application of the Insurance Premium Tax. But does the planned review go far enough?

Blog: Claim sharing – the insurance alternative that cuts out the regulator

Despite a number of technological revolutions, general insurance hasn’t altered much since it was first conceived centuries ago in City of London coffee shops. You Do Pet founder Paul Dennis argues 'claim sharing' might be about to change that.

Ecclesiastical and CFG call for IPT charity exemption to be included in this month's budget

Specialist insurer, Ecclesiastical and the Charity Finance Group have called on the chancellor to make charities exempt from paying insurance premium tax.

Claims II: Victims of Nice terrorist truck attack receive €37m

Two years after the truck attack in Nice, southern France, the terror compensation fund has paid out €37m (£33m) to 2135 victims, who were either injured in the attack or are relatives of casualties.

Victims of Nice terrorist truck attack receive €37m

Two years after the truck attack in Nice, southern France, the terror compensation fund has paid out €37m (£33m) to 2135 victims, who were either injured in the attack or are relatives of casualties.

CII launches Aspire Apprenticeship programmes

The Chartered Insurance Institute has launched its Aspire Apprenticeship programmes.

Watchstone losses continue as group prepares for divestment

Watchstone made an underlying Ebitda loss of £3.6m in 2017, compared to a loss of £4.9m in the previous year.

Brokers informed: W&I for bricks and mortar

Warranty and indemnity insurance has seen significant growth in the real estate sector over the last few years. And, with the cover offering significant advantages to those involved in real estate deals, many expect it to become a standard part of any…

Analysis: Risks, challenges and opportunities of commercial use of listed buildings

Underinsurance casts a long shadow across the world of listed properties, especially when owners are constantly expanding commercial activities. Experts warn that there can be many traps for the unwary or naïve, many of which do not come to light until…

Hurricanes put Zurich's P&C segment in the red

Nat cats pushed Zurich’s property & casualty segment into the red last year, as hurricanes Harvey Irma and Maria saw the insurer report a 100.9% combined operating ratio for P&C.

Blog: There will be a tsunami of new apprenticeships

Don’t write the apprenticeship levy off just yet, says Matthew Metcalfe, claims manager at Covéa Insurance, explaining why the future’s bright for new apprenticeships.

Analysis: Review of the year 2017

The past year has been a stormy one for the insurance market – and not just in terms of weather: the discount rate saga and the insurance premium tax hike helped propel motor premiums to stratospheric highs. Industry figures see clearer skies, however,…

Week in Post: All hail Captain Side Parting

This year’s Budget was rewarding for many reasons: a freeze on insurance premium tax, an increase in research funding for driverless cars, and a dig at Jeremy Clarkson.

MP launches petition to freeze IPT rise

An MP has launched a petition urging the government not to raise the Insurance Premium Tax in next week’s budget.

Ageas' Andy Watson's wish list for returning MPs

As goverment returns to business, Andy Watson, CEO of Ageas UK, reminds MPs that there are still three major areas of policy affecting insurance that need to be properly addressed before insurers can begin to control and then reduce customer premiums.

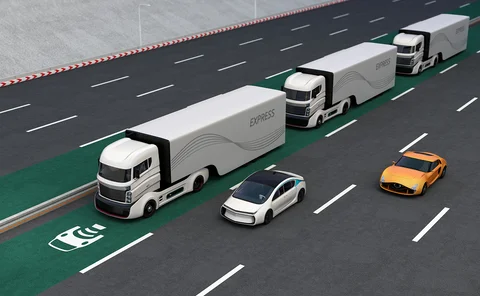

This Week in Post: Is there a driver on board this truck?

Living in South London, I’m in an on-off relationship with my broadband connection. My unreliable web access is irritating – although it is probably not as bad as in certain rural areas.

Gibraltar: Between a Rock and a hard Brexit

A minority of Gibraltarian insurers could suffer from the loss of European passporting rights but the territory could also attract companies looking to enter the UK market after Brexit.

Interview: Jeremy Hyams, Claims Consortium Group

Jeremy Hyams started his business with a £500 start-up bank loan 20 years ago. Now, CEO of Claims Consortium Group, he was recently the recipient of the Queen’s Award for Innovation.

Biba’s Steve White on keeping abreast with politics

Lobbying is a long game, writes Steve White, chief executive of the British Insurance Brokers’ Association, explaining why his trade body is cultivating its connections with both the government and the shadow cabinet.

Brexit: The location game

With Brexit negotiations now launched, insurers are taking steps to secure their access to the European market. How many will follow Lloyd's to Belgium?

Blog: The apprenticeship levy might not be as bad as you think

After two years of waiting – and wondering – the apprenticeship levy is upon us. And so, for those of you with an annual paybill of over £3m, you’ll now be paying 0.5% of that to HMRC.

Chancellor’s budget of ‘little comfort’ to insurers

Chancellor Philip Hammond's Spring budget is of "little comfort" to insurers due to recent insurance premium tax hikes, trade bodies say.