British Insurance Brokers’ Association (Biba)

FOS aims to slash insurance complaints queue

The Financial Ombudsman Service intends to change the way it records the number of complaints against insurance companies, in a bid to encourage more businesses to settle with policyholders before an investigation is launched.

Diary of an Insurer: Axa Commercial's Sarah Mallaby

Sarah Mallaby, distribution and trading director of Axa Commercial, prepares for the Biba conference, the British Insurance Awards and gets ready to launch new propositions in SME and motor trade.

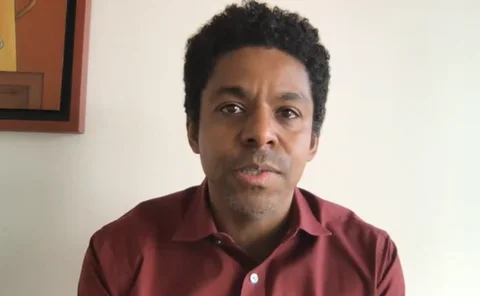

Interview: Peter Elliot on why he gave up the insurance boardroom to drive aid ambulances to Ukraine

To mark the first anniversary of the Russian invasion of Ukraine Jonathan Swift spoke to retired insurance marketing veteran Peter Elliot about how the conflict changed his life.

Insurance Post Podcast: Are insurers ready for the FCA’s Consumer Duty?

Insurers who think they've already met the Financial Conduct Authority’s Consumer Duty requirements shouldn't be "resting on their laurels", DAC Beachcroft has warned.

Why insurance should be recession proof

Editor's View: Insurance Post Editor Emma Ann Hughes kicks the tires of insurance to see if the industry is right to be pessimistic about its prospects at the moment.

Regulation and cyber dominate in Biba's 2023 manifesto

The British Insurance Brokers’ Association has laid out increasing take-up of cyber insurance and reducing the cost regulation as top priorities for 2023.

Trade Voice: Biba CEO on why brokers should listen to the Dalai Lama

Steve White, CEO of the British Insurance Brokers' Association, explains why brokers should listen to the Dalai Lama and be clear with customers about what "bang they are getting for their buck."

Jonathan Evans re-elected as Biba chair

The board of British Insurance Brokers’ Association has extended Jonathan Evans’ tenure as chair of the association for a further three years.

Sunak's plans to create more data analysts welcomed

Prime Minister Rishi Sunak’s plan to ensure all pupils in England study some form of maths until aged 18 has been welcomed by industry trade bodies.

Most-read insurance stories in 2022 revealed

The most-read Post stories of 2022 show what captured the insurance industry's attention as pandemic restrictions were lifted, inflation soared, many sectors went out on strike for improved pay and cyber-crime continued to escalate.

FCA says it will ensure ‘the polluter pays’ in FSCS review update

The main theme of feedback to a recent review of the Financial Services Compensation Scheme was the importance of firms improving their conduct to reduce the frequency at which the scheme is called into action, the Financial Conduct Authority has said.

Briefing: Government makes demands to Biba in response to ‘disturbing remuneration’ practices

The Secretary of State for Levelling Up, Housing & Communities, Simon Clarke has demanded ‘immediate changes’, ordering the British Insurance Brokers’ Association to address ‘disturbing’ remuneration practices following a Financial Conduct Authority…

Intelligence: Tackling subsidence surges in a climate change era

With hot summers becoming more likely in the future, subsidence surge and event years may be the new norm. Fiona Nicolson looks at how insurers are preparing for these claims in a climate change environment.

Insurance fraud expected to rise this year, reversing 2021 trends

Insurers and counter-fraud specialists expect the level of insurance fraud to increase this year, with the cost-of-living crisis driving more people to make dishonest claims.

Intelligence: Grenfell - five years on

Five years have passed since 72 victims lost their lives after after a fire ripped through a building featuring unsafe cladding. Rachel Gordon investigates what insurers have learnt from this, how building standards have moved on and if the prospects of…

Cool industry reception for regulatory interventions to solve dearth of cover

The Federation of Small Businesses has called on the Financial Conduct Authority to act in response to a survey it conducted that found that many businesses are finding it difficult to find insurance.

FSB calls on insurance industry to tackle widespread confusion over what commercial policies cover

The Federation of Small Businesses has called on the insurance industry to improve the clarity of policy wordings after it found that 30% of small businesses and the self employed have difficulties understanding what their insurance covers.

Biba targets a return to verbal communication with brokers to combat 'misunderstanding'

The British Insurance Brokers' Association wants insurers to bring verbal communication with brokers back to the claims process to "cut down the misunderstanding rate".

EY predicts motor NCR of 113.8% in 2022; Geo buys Lorega; Konsileo secures Series A funding; and ex-Fresh trio launch new broker

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Analysis: A ‘boring’ reputation leaves brokers facing hiring struggles

Recruitment issues have hindered UK brokers’ optimistic growth expectations and are impacting insurance brokers of all sizes, according to research from Aviv

Government-backed PI scheme for fire safety assessors to launch in September

A government-backed professional indemnity scheme for EWS1 assessors is set to launch in September and will last for five years.

Ecclesiastical’s Saunders says keep up the momentum on mental wellbeing

With the UK economy potentially entering into recession, and concerns that the cost of living crisis could turn into a mental health crisis, Adrian Saunders, commercial director at Ecclesiastical, urges the market to keep mental wellbeing front of mind.

Howden acquires Tiger Risk; JMG buys GS Group; Allianz and Ifed secure convictions for fraudsters; and First Central in CMT tie-up

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Broker contributions to FSCS slashed as forecast levies are revised down

The Financial Services Compensation Scheme has issued final levies for 2022/23 of £5.3m for brokers and £211.7m for insurers, down significantly on initial estimates.