Insurer

Zurich and Aon develop ‘Lego-like’ hydrogen insurance cover

Zurich and Aon took a “Lego-like” approach to developing its clean hydrogen insurance facility due to the challenges of developing blue and green hydrogen projects.

What Labour’s landslide victory means for insurance

Sir Keir Starmer, the nation’s new prime minister after Labour’s landslide general election victory, as well as key insurance industry figures, have the same message: “change begins now”.

Freedom’s car integration; Tradex joins IFB; DWF’s chair

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Climate change activists target British Insurance Awards

Extinction Rebellion targeted the Insurance Post British Insurance Awards 2024 tonight (3 July) as part of its latest month of activity.

LexisNexis working on Jaguar Land Rover security solution

LexisNexis Risk Solutions is working on a way for Jaguar Land Rover to get its vehicle security data to insurers to address pricing issues, Insurance Post can reveal.

Tui ditches Axa for Allianz on travel insurance

Allianz Partners has been appointed travel insurance provider for Tui’s UK business, with the holiday provider ending its partnership with Axa Partners in April.

How to become an underwriting trailblazer

Only 8% of insurers can consider themselves to be property and casualty underwriting trailblazers, according to a survey of the sector.

Aviva sees 65% increase in non-whiplash injury claims

Non-whiplash-related injury claims have jumped by nearly two-thirds since the whiplash reforms, Aviva’s head of counter-fraud Pete Ward has told Insurance Post.

Instanda CEO 'taken aback' by rival tactics

Instanda CEO Tim Hardcastle has claimed “established” insurtech providers are far from “fair and open” when competing with his business for deals with major insurance companies.

Plugable’s charger scheme; FSCS’ claims partnership; Aon’s broking head

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

‘A lot of gaps’ to fill in Automated Vehicles Bill

There are still gaps left to fill regarding the use of automated vehicles, according to the Association of British Insurers’ manager for general insurance policy, Jonathan Fong.

Zurich to review family friendly HR policies

Zurich’s human resources and actuarial teams are conducting a review of its family friendly policies and benefits, Insurance Post can reveal.

Hiscox uses AI to slash underwriting from three days to three minutes

Hiscox has shortened its lead underwriting journey for the London Market sabotage and terrorism book from three days to three minutes through the use of generative artificial intelligence.

How generative AI is everything, everywhere in insurance all at once

How insurers have been able to swiftly pilot generative artificial intelligence, prove the value of embracing this technology and roll it out across the wider business is examined by Insurance Post Editor Emma Ann Hughes.

Cifas sees false insurance claims increase by a fifth

Opportunistic drivers submitting false ‘no claims’ documents are raising concerns for insurers, with filings to the National Fraud Database increasing in 2023, according to Cifas.

EU AI Act may block smaller insurtechs from market entry

Smaller insurtechs in the artificial intelligence sector will be subject to additional regulatory oversight due to the European Union AI Act, which may prevent them from making it into the market, according to Sixfold CEO Alex Schmelkin.

Insurance market has rushed automation – survey

Many technology professionals at insurers and MGAs believe the market has rushed into automation, according to a survey by RDT Tech.

Ageas reveals AI has saved business more than £4m

Ageas has saved more than £4m due to the use of artificial intelligence, with £2m of the savings coming from AI-enhanced fraud models.

Ecclesiastical is cautious about generative AI for complex tasks

Ecclesiastical’s generative artificial intelligence technology is not ready to support high value or complex task replacement, according to group technology director Graeme Howard.

Consumers want Amazon and Tesla embedded insurance products

Four out of 10 consumers would be comfortable with the idea of buying insurance from companies such as Ikea, Amazon, or Tesla when making purchases from those brands, according to Guidewire’s Insurance Consumer Survey 2024.

Is insurer service really that bad?

News Editor View: After comments from Jensten’s Alistair Hardie earlier this week saying no insurer gets service right and that we should “rip up the service rule book and start again”, Scott McGee asks: Is it really that bad?

What Labour’s Manifesto means for insurers

Labour leader Sir Keir Starmer aimed to woo insurers when he outlined his party’s blueprint for government just before lunchtime today (13 June).

Three key takeaways from ITC DIA Europe 2024

Artificial intelligence can be used to close the digital gap in insurance; meanwhile, some feel that generative AI is just a temporary hot topic, according to experts gathered at ITC DIA Europe, which took place in Amsterdam this week.

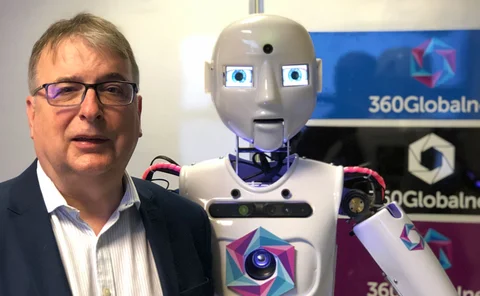

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.