Whiplash

Apil’s Jonathan Scarsbrook on why consumers should be furious

Trade Voice: Jonathan Scarsbrook, president of the Association of Personal Injury Lawyers, argues costlier-than-ever car insurance isn’t delivering for consumers.

Biba’s budget demands; Tokio Marine’s deal with Lavaretus; NFU’s first commercial head

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

‘Serious questions’ to be answered as MoJ launches whiplash tariff review

The Ministry of Justice has opened a call for evidence into the Whiplash tariff, first introduced in 2021, as part of a statutory review.

Q&A: Pete Allchorne, Forum of Insurance Lawyers

Pete Allchorne, president of the Forum of Insurance Lawyers and partner at DAC Beachcroft, talks to Insurance Post about the big developments in the legal sphere this year.

Claims and Legal Review of the Year 2023

Looking back at 2023, law firms and claims professionals reflect on how double digit inflation hit the sector and look forward to artificial intelligence speeding-up administration in 2024.

UK motor broker launches; Ardonagh’s management reshuffle; Polaris’s £1.5m investment

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Whiplash exodus continues as 53% of law firms pull out of sector

Over half of law firms are ditching low-value RTA claims as a result of the whiplash reforms, with only one firm saying this area of business is profitable.

MoJ told to fix whiplash before introducing more reform

Panellists speaking at an Association of British Insurers event about civil justice urged the Ministry of Justice to fix the whiplash reforms before bringing about any new further changes that affect the motor insurance sector.

Would a state-owned motor insurer help ongoing policyholder woes?

Content Director’s View: With the political parties preparing for the next general election, Jonathan Swift mulls whether Labour Shadow Transport Secretary Louise Haigh’s promise to go on the offensive over the costs of motoring might have unintended…

MPs call for OIC case backlog investigation

In a report published today, the Justice Committee has urged the Ministry of Justice to investigate the case backlog within the Official Injury Claim portal.

Motor insurance payouts rose faster than premiums in Q2

The Association of British Insurers has revealed that motor insurance payouts rose by 29% in Q2, up to £2.5bn, outpacing premiums.

Aston Lark’s latest acquisition; World Nomads’ travel product partnership; and Lloyd’s unveils Women’s Cricket Team

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Trade Voice: Mass’s Brown on whether whiplash reforms were worth it

Sue Brown, chair of the Motor Accident Solicitors Society, asks whether motor policyholders will ever see a ‘whiplash dividend’.

Apil alleges ‘clear justice gap’ within personal injury claims

Analysis of the latest Official Injury Claim data by the Association of Personal Injury Lawyers alleges that a “clear justice gap” is present when it comes to road injury claims.

Could a motor insurance crisis become a political storm?

Content director's view: As Zurich pulls out of the personal lines broker market, and with motor far from being flavour of the month for investors and capacity providers, Jonathan Swift asks could a combination of withdrawals and lack of new competition…

Former Foil president predicts more legal consolidation

Further consolidation of the insurance defendant legal market is on the cards, according to Keoghs partner and former Forum of Insurance Lawyers president Don Clarke.

Insurers granted permission to appeal mixed-injuries ruling

The Court of Appeal has granted permission for the Association of British Insurers to appeal the decision of the first two cases of mixed-injury claims involving both whiplash and non-whiplash injuries, Insurance Post can reveal.

Interview: James Dalton, MIB

In his first interview since joining the Motor Insurers’ Bureau as chief services officer, and two years after the introduction of the Official Injury Claims portal, James Dalton chats to Pamela Kokoszka about how he is taking on the challenge to remove…

Insurance reflects on two years of the OIC portal

Today marks two years since the Official Injury Claims portal was launched. Industry experts react to the progress the portal has seen, teething troubles it has overcome, and what is still in need of work.

RSA’s personal motor withdrawal was More Than inevitable

Content Director's View: Jonathan Swift reflects on RSA's withdrawal from personal motor and concludes it had been coming for a few years now.

WTW partners with Sapiens; Zurich expands regional network; Pen UW creates head of IP

Friday Round Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

‘Major reset’ expected in motor personal injury two years on from whiplash reforms

Minster Law CEO Shirley Woolham said following a complex year that saw industry come out of a pandemic and continue to deal with the aftermath of whiplash reforms, the personal injury motor market is transforming into a different landscape.

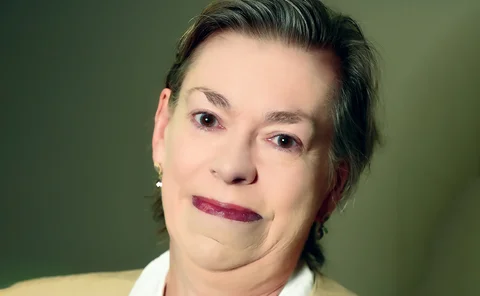

Q&A: Nicola Critchley, Foil

Nicola Critchley, partner at DWF, and president of Foil since November 2022, catches up with Insurance Post to discuss what she hopes to achieve during her time as president, what is on the agenda for 2023, and how the body will support member firms and…

OIC’s Martin Saunders reflects on the portal’s journey to success for claimants

Following recent feedback that the portal is not operating correctly, Martin Saunders, head of service for Official Injury Claim addresses some of the more recent media inaccuracies and sheds light on why the portal is a successful route to justice for…