Opinion

How D-Day was reported by Post

To mark the 80th anniversary of the Normandy landings and D-Day, we dip into our 184-year archive to see what Insurance Post said at the time.

What a Labour victory means for insurance

James Daley, managing director of the research and consultancy group Fairer Finance, reveals who should fear the approach of a new Labour administration and what companies could thrive if the Conservative Party are ousted at the general election on 4…

Known unknowns and the certainty of net zero

On World Environment Day (5 June), Ofir Eyal, director at consultancy Marakon, examines how the insurance industry is balancing the trade-off between revenue and reputation when it comes to climate planning.

Insurance’s problem with a shrinking pool of arbitrators

Mark Everiss, partner in insurance and reinsurance at Eversheds Sutherland, explores the practicalities of, and difficulties in, finding a competent impartial tribunal of arbitrators to determine insurance and reinsurance disputes.

Understanding flood resilience – one garden and brick at a time

Editor’s View: Emma Ann Hughes considers ways the insurance industry can help make the world more resilient to climate change by being more innovative in how it inspires adapting homes and gardens.

Redefining risk with Martyn’s Law

Paul Tarne, partner at law firm Weightmans, explains how landmark counterterrorism legislation Martyn’s Law will affect insurers.

How AI can place insurers in the green lane

Bill Brower, senior vice-president of global industry relations and claims sales at Solera, explains how artificial intelligence will be pivotal in moving the needle on insurer's environmental, social and governance goals.

Groundhog day after 39 years at the ABI

After retiring from the trade body, Malcolm Tarling, former chief media relations officer at the Association of British Insurers, urges providers to avoid trying to make their products sexy and says clear communications are essential in the fight to…

Is premium finance still a tax on the poor?

News Editor’s View: Scott McGee considers whether recent steps taken by trade bodies to address premium finance will reassure the Financial Conduct Authority that this payment method is no longer a ‘tax on being poor’ that needs to be tackled.

Allianz’s Fletcher on fraud prevention in the age of technology

View from the Top: Ben Fletcher, director of financial crime at Allianz Personal, calls for the industry to prioritise prevention over reaction in the fight against fraud.

Overcoming the challenge of insuring self-driving vehicles

Andrew Ballard, product principal for LexisNexis Risk Solutions, Insurance, explains how the Automated Vehicles Bill could help ensure insurers have access to the data needed to insure self-driving vehicles.

CII Broking Community’s Patel on insurance’s war for talent

Trade Voice: Isha Patel, managing director for the South East at Partners& and a member of the Chartered Insurance Institute’s Broking Community, says the industry needs to go above and beyond remuneration to attract talent.

Building Back Better at Chelsea Flower Show

Flood Re’s Build Back Better scheme is being used to not only fund internal flood resilience changes but also adaptations to outside space and gardens in the quest to stop and reduce flood waters entering properties, explains Stephen Linklater, claims…

Efficient rehabilitation starts with understanding limb loss

Jason Chidwick, specialist rehabilitation case manager and amputee clinical lead at HCML, explains how personal injury professionals work with insurers to achieve the best outcomes for amputees.

Sobering reading for those with a Biba hangover

Editor’s View: If you are nursing a hangover after going to this year’s British Insurance Brokers’ Association conference then Emma Ann Hughes reckons you missed the point of attending the annual gathering in Manchester.

Aon’s Thelwell on ensuring quality and support for UK businesses

View from the Top: Joe Thelwell, UK head of SME at Aon, outlines how the sector can usher small and medium-sized businesses through heightened volatility.

What prompted FCA checks on bullying in insurance?

Jeremy Irving, head of the financial services regulatory practice at law firm Browne Jacobson, considers what could have prompted the Financial Conduct Authority looking into non-financial misconduct in the insurance industry.

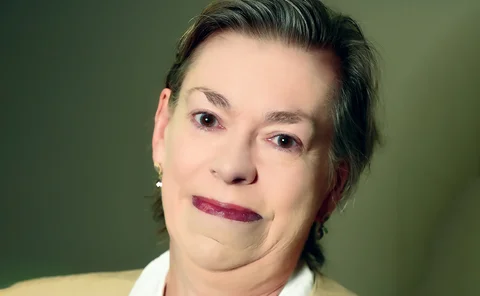

Mass’s Sue Brown on why the whiplash tariff should be reviewed annually

Trade Voice: Sue Brown, chair of the Motor Accident Solicitors Society, says annual reviews need to be introduced at the earliest opportunity to address the perhaps irreparable damage done by the 2018 reforms.

Has the Biba Conference shed its ‘Butlin’s for Brokers’ reputation?

Content Director’s View: Jonathan Swift looks at whether the British Insurance Brokers’ Association Conference has shed its image as a booze-up for brokers and how it might have achieved it.

Markerstudy’s Lizzie Smith-Foreman on the importance of a sustainability strategy

View from the Top: Lizzie Smith-Foreman, director of group marketing, communications and sustainability at Markerstudy, says that clear sustainability aims are a must if you want to keep doing business with your partners and customers.

Why insurance companies love furry faces

Building desirable brands in the insurance market is a challenge, but it all boils down to the right level of distinctiveness, and of course, it helps to have a lovable mascot that evokes an emotional connection, writes Rob Allen, strategy partner at…

Biba’s Trudgill on working with the regulator

Trade Voice: Graeme Trudgill, CEO of the British Insurance Brokers’ Association, outlines how overtures between the trade body and the Financial Conduct Authority might ease brokers' uncertainty around regulation.

Is the home insurance market set for a reckoning?

Editor’s View: Emma Ann Hughes warns home insurers to brace themselves to be the next target of policyholders’ wrath as moaning motorists are replaced by angry-looking property owners on national newspapers’ personal finance pages.

RSA’s Sonya Bryson on what ought to be insurers’ North Star

View from the Top: Sonya Bryson, commercial lines managing director for RSA Insurance, discusses how the insurance sector can adapt to today’s challenging economic landscape.